Thinking of Buying a House Before Year-End: If you’re thinking about buying a house before the year ends in 2025, you’re not alone. The U.S. housing market has been on quite a ride recently, causing many to ask: is this really the right moment to jump into homeownership? This article breaks down the truth behind home prices, mortgage rates, market conditions, and some inside tips that could save you money and stress. Whether you’re a first-time buyer or a seasoned investor, consider this your friendly, trusted guide to making a confident decision. Buying a home isn’t just about finding a spot you love; it’s also about timing, market trends, and understanding subtle factors that impact your purchase’s value and future. By the end, you’ll be equipped with clear, practical advice tailored to today’s market—and the confidence to act wisely.

Thinking of Buying a House Before Year-End

Thinking of buying a house before year-end 2025? The market is steady, with modest price changes and easing mortgage rates providing an attractive window for buyers with steady finances. Yet, beyond numbers, success hinges on understanding local neighborhood factors, inspecting properties thoroughly, and negotiating smartly. Prepare well, act confidently, and you can secure a home that’s both a smart investment and a cozy place to live through changing markets.

| Topic | Data/Insight |

|---|---|

| Average U.S. Home Value | $360,727, up 0.1% year-over-year as of November 2025 |

| Mortgage Rates (30-year fixed) | Around 6.18%, trending slightly downward from past months |

| Home Price Growth | Slow and steady, about 2.3% annual rise in prices |

| New Home Sales (Aug 2025) | Average sale price $534,100, volume up 15.4% year-over-year |

| Inventory Levels | Single-family existing homes inventory up 20% year-over-year, but still below prior lows |

What’s Happening With Home Prices?

Home prices in the U.S. are currently doing the slow dance—no skyrocket, no crash. The average home price hovers around $360,727, showing a modest 0.1% increase over the last year. This signals a market that’s steadying itself after the rapid inflation during pandemic years, providing some relief for buyers anxious about affordability.

But stability doesn’t mean uniformity. Certain cities have seen distinct changes: places like San Francisco and Austin experienced price corrections of 10-13% from their peaks, reflecting less overheated local markets. These shifts highlight just how much location still drives price trends, underlining the importance of local market research.

Despite slower income growth relative to home prices, many existing homeowners have built significant equity, and renters who’ve benefited from stock market gains are now armed with financial resources to make competitive down payments. This “wealth effect” sustains demand and supports slow, steady price growth around 2-3% annually, even amidst broader affordability headwinds.

Mortgage Rates: The Real Game Changer

Still, mortgage rates remain the biggest factor to watch. After peaking near 8% in late 2023, rates have eased to about 6.18% for a 30-year fixed mortgage as of November 2025. Though higher than the historically low pandemic-era rates, they have recently trended downward, offering some breathing room for buyers.

Why does this matter? Because even a half-percent change in your interest rate can lower or raise your monthly payment significantly. That difference could mean affording a larger home or saving hundreds every month on mortgage costs.

Here’s a rough guide to current rates:

- 30-year fixed: ~6.18%

- 15-year fixed: ~5.51%

- Rates show signs of slight decline, influenced by Federal Reserve easing and economic conditions, but a return to sub-4% rates in the near term is unlikely.

Locking in your mortgage rate now, especially before anticipated economic or policy shifts, could be a wise move.

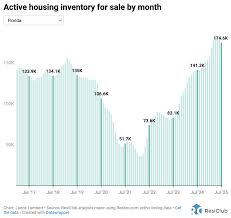

Inventory Is Improving — But Not Overflowing

Another essential buying factor is inventory—how many houses are available for sale? More homes generally mean less competition and better price negotiation power.

Current data shows inventory for single-family homes is about 20% higher than last year, though still 20-30% below historical averages. This relative scarcity maintains price stability and competition among buyers.

Meanwhile, builders are pushing back against slowdowns by increasing new home sales, which rose over 15% year-over-year, with the average new home price hitting $534,100. Builders also offer buyer incentives such as closing cost assistance and upgraded features, especially for “quick move-in” spec homes to clear out inventory.

Still, the supply-demand balance remains tilted in favor of sellers in many markets, meaning buyers should prepare for competitive bidding in popular areas.

Thinking of Buying a House Before Year-End: The Hidden Factors Experts Aren’t Telling You About

Beyond price tags and rates, some details can majorly affect your home’s value and suitability:

- Neighborhood Characteristics: Proximity to noisy highways, industrial zones, or higher crime rates can decrease value by 10-15% or more. It’s crucial not to just go by curb appeal but to dig into local data on safety and noise pollution.

- Environmental Risks: Homes in floodplains or wildfire-prone areas tend to have higher insurance costs and may face tougher resale challenges.

- Unique Property Traits: Yard slope, exposure to airport noise, and the age or condition of major components like roofs and heating systems can affect livability and resale value.

- Local Economy & Development: Neighborhoods with growing job markets tend to hold or increase in value. Conversely, if new construction or commercial developments are slated nearby, values can shift—sometimes down if traffic worsens or up if amenities improve.

- Construction Costs and Labor: Tariffs on steel, lumber, and aluminum, plus labor shortages, have increased homebuilding costs. These factors contribute to tighter supply and kept prices from dropping significantly despite recent sales slowdowns.

Getting a professional home inspection and consulting local municipal records can help you uncover these hidden factors before committing.

Timing: Why Buying Before Year-End Makes Sense

You may wonder, why buy before 2026? The answer isn’t just the calendar but overall market and personal financial conditions.

- Prices are expected to continue rising modestly or stay flat—waiting could mean paying more or facing tougher competition.

- Mortgage rates, while higher than recent history, show a slight downward trend, improving your affordability window.

- Inventory improving but still limited suggests it’s a decent time to shop.

- If your income is steady and your finances solid, acting now locks in your position before the market potentially tightens again.

- However, if you expect income instability or major life changes soon, it might be smarter to pause and reassess.

Ultimately, the best time to buy is when your financial and personal circumstances are ready.

Step-by-Step Guide to Buying a House Before Year-End

1. Assess Your Financial Health

Check your credit score (aim for 700+ for best mortgage rates), review savings, and establish your monthly budget. Don’t forget to factor in property taxes, insurance, and maintenance costs.

2. Get Pre-Approved for a Mortgage

Pre-approval demonstrates your buying power to sellers and helps you know your realistic price range.

3. Research Neighborhoods Thoroughly

Investigate school ratings, crime stats, environmental hazards, and future plans like new highways or commercial development. Tools like local government websites and crime maps are useful.

4. Partner With an Experienced Real Estate Agent

A savvy agent helps spot good deals, negotiate contracts, and navigate complex paperwork.

5. Schedule a Comprehensive Home Inspection

Ensure a thorough inspection checks for foundation issues, roofing, HVAC, plumbing, and electrical systems.

6. Make an Informed Offer

Consider all deal components: price, contingencies, repair requests, and closing terms. Sometimes offering flexible closing dates or waiving minor repairs can seal a deal.

7. Prepare for Closing

Gather required documents, understand closing costs (typically 2-5% of purchase price), and finalize mortgage details ahead of time.

Financing Tips for Buyers

- Consider locking in your mortgage rate early to protect against upward moves.

- Investigate first-time homebuyer programs and grants in your state or city.

- Maintain an emergency fund to cover unexpected repairs or moving expenses.

- Understand different mortgage types—fixed-rate vs adjustable-rate mortgages (ARMs) can impact long-term costs.

- Shop around and compare lenders—not all mortgage offers are equal.

US Visa Waiver Program 2025 Just Updated; Here’s Who Can Now Enter America Without a Visa

SSDI Payment Schedule for November 2025: Check Payment Dates and Amounts

$200 Monthly Boost? New Proposal Could Supercharge Social Security Benefits