The Hidden 401(k) Trap: Switchin’ jobs is the American dream — new gigs, better pay, fresh opportunities. But here’s a hard truth: millions of us are losin’ out on a big chunk of retirement cash every time we switch jobs without even realizing it. This is called the hidden 401(k) trap, and it’s robbing hardworking Americans of their future financial security. If you’re wondering what actually happens to your 401(k) when you change jobs, how you might be losing money, and what you can do to protect and grow what’s yours, this article breaks it all down in clear language anyone can understand. Whether you’re a busy professional or just dipping your toes into retirement planning, you’ll walk away with practical steps and insider tips to keep your retirement savings safe.

The Hidden 401(k) Trap

The hidden 401(k) trap is a growing financial pitfall that costs Americans billions of dollars every year. Millions of forgotten accounts and early cashouts diminish what should be a bright retirement for many. The good news: with awareness, timely action, and smart financial choices, you can protect your retirement assets from slipping away. Take control before your retirement toolbox closes. Track your old accounts, avoid cashing out, and roll over your 401(k)s properly to keep growing your nest egg. Your future self will thank you.

| Aspect | Details |

|---|---|

| Forgotten 401(k) Accounts | About 32 million accounts holding over $2.13 trillion, growing 30% in two years |

| Average Forgotten Account Balance | Increased to $66,691 in 2025 from $56,616 in 2023 |

| Annual Growth in Forgotten Accounts | 3.5 million left behind in 2023, 4 million in 2024, and 4.2 million predicted in 2025 |

| Percentage Who Cash Out on Job Change | 41.4% cash out their 401(k) when leaving a job |

| Fees on Forgotten Accounts | Average monthly fees ~$4.55, slicing thousands over decades |

| Penalty for Early Withdrawal | 10% federal penalty plus income taxes |

| Official Tool to Track Lost Accounts | U.S. Department of Labor’s Retirement Savings Lost & Found database |

What Is The Hidden 401(k) Trap?

When you leave a job, you’ve got choices for your 401(k) retirement plan: leave it with your old employer, roll it over to your new employer’s plan, move it to an IRA (Individual Retirement Account), or cash it out. But many fall into a trap from lack of awareness or bad advice:

- Leaving funds forgotten in old accounts

- Cashing out early and facing steep penalties and taxes

- Involuntary rollovers to low-interest or cash accounts

- Hidden management fees bleeding your savings silently

The scale of this problem has ballooned in recent years. As of mid-2025, there are approximately 32 million forgotten or untouched 401(k) accounts collectively holding over $2.13 trillion in assets. That means nearly one-quarter of all 401(k) dollars in the U.S. are parked in accounts potentially not being actively managed or growing as much as they could be.

This surge is partly driven by ongoing job churn, higher participation in 401(k) plans, and an outdated, manual process for rolling over retirement funds. Alarmingly, every year millions of workers leave behind accounts with balances growing larger—the average forgotten 401(k) balance has increased from about $56,616 in 2023 to $66,691 in 2025.

Why Does This Happen So Often?

Here’s why many folks fall victim to this trap:

- Lack of awareness: At the moment of job change, employees often get little or confusing guidance on what to do with their 401(k). Many don’t realize the importance of timely rollovers or the risks of inaction.

- Misconceptions about cashing out: Some see cashing out as “free money” or a quick fix to cover bills or emergencies, ignoring that penalties and taxes can shrink their savings significantly.

- Confusing paperwork and processes: The rollover process can feel intimidating and manual, leading many to procrastinate.

- Fees quietly eating savings: Even modest monthly fees (estimated at ~$4.55 on average) compound over decades, leaving workers with thousands less at retirement if accounts remain forgotten.

- Psychological factors: Immediate spending often weighs more heavily in decision-making than long-term savings benefits, tempting early withdrawals or neglect.

This combination means that millions lose out on hundreds of thousands over their working lifetimes, sometimes unknowingly.

How Does The Hidden 401(k) Trap Hurt Your Future?

1. Early Withdrawal Penalties

Cashing out a 401(k) before retirement comes with a one-two punch: a 10% early withdrawal penalty, plus ordinary income taxes on the withdrawn amount. For example, if you take out $20,000, you might owe $3,000 in penalties alone, plus significantly more in taxes depending on your tax bracket. Then, you lose out on decades of compounding growth on that money, which is often the biggest blow to your retirement future.

2. Lost Compound Growth

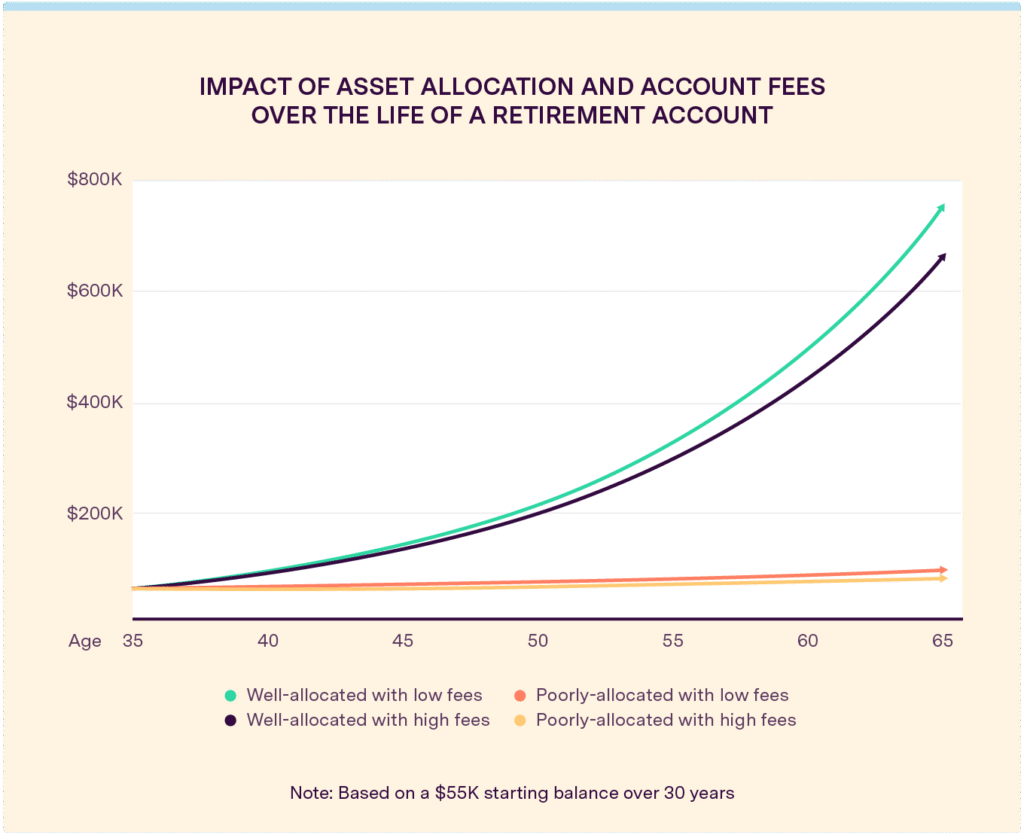

Compound growth is the investment returns on your original savings plus the returns they’ve already earned, and when you leave funds inactive — especially if moved involuntarily to cash or low-yield accounts — you miss out on this powerful wealth-building mechanic. Missing even 10 years of compounding can cut your eventual nest egg by 40% or more.

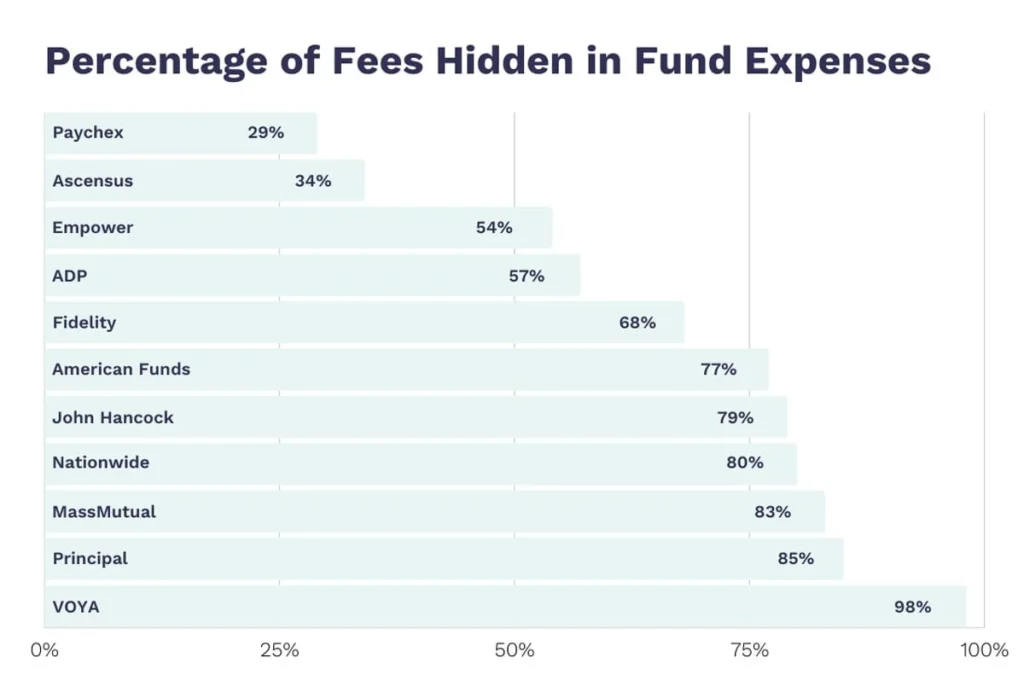

3. Hidden Fees

A forgotten 401(k) sitting in an old employer’s plan may incur ongoing fees such as administrative charges and investment fees, averaging roughly $4.55 per month. While that looks minor, over a 30-year career, it can quietly drain nearly $18,000 from your savings. Higher fees also mean less money to invest, so your growth slows down.

4. Keeping Track Becomes Harder

The reality of multiple job changes means workers often accumulate numerous 401(k) accounts. Without efforts to consolidate or track these accounts, they become “lost” or forgotten, making portfolio oversight difficult and increasing the risk of missing out on valuable investment opportunities or fee reductions. Financial experts warn that many people may miss out on upwards of half a million dollars in potential savings over a lifetime by neglecting small or forgotten accounts.

5. Federal Government Workers and Growing Risks

Special concerns now exist for federal government employees, who face layoffs and plan changes that have led to a spike in forgotten accounts within the Thrift Savings Plan (TSP). Nearly 3 million TSP accounts are projected to be left behind by the end of 2025—a rise of 14% compared to 2024—adding another layer to the growing lost retirement savings challenge.

Step-by-Step Guide: How to Roll Over Your 401(k) and Avoid The Hidden 401(k) Trap

To steer clear of this trap, actively managing your retirement funds when switching jobs is crucial. Rolling over your 401(k) into a new account can preserve your savings and provide better options. Here’s a detailed, professional guide:

Step 1: Decide on Your Rollover Destination

- New employer’s 401(k) plan: This is simplest if your new employer offers one and accepts rollovers. It keeps your money consolidated and possibly benefits from plan-specific advantages like lower fees or loan options.

- Individual Retirement Account (IRA): Offers flexibility with a wider range of investment options and control, especially useful if you anticipate future job changes or want a tailored investment strategy.

- Do not cash out: Avoid this unless in extreme financial hardship.

Step 2: Open Your New Retirement Account

If moving to an IRA, you must open an account with a reputable provider. Big names include Fidelity, Vanguard, Charles Schwab, or your brokerage of choice. This account will receive your rollover funds.

Step 3: Contact Your Old 401(k) Plan Administrator

Get in touch with your old plan provider to request rollover instructions and forms. Ensure you opt for a direct rollover (trustee-to-trustee transfer) where the funds go straight to your new plan or IRA. This avoids automatic tax withholding and penalties.

Step 4: Monitor the Transfer

The rollover process can take 2–4 weeks. Make sure you confirm with both your old and new providers that the transfer is complete. If you receive a check payable to you, deposit it into your new account within 60 days to avoid taxes and penalties.

Step 5: Invest Thoughtfully

Once funds are in your new account, review your investment mix. Align your choices with your retirement timeline, risk tolerance, and goals. Consider broad-based index funds or target-date funds for diversified exposure.

Step 6: Keep Records and Stay Informed

Maintain documentation of every rollover for tax purposes. Regularly review your retirement accounts annually and after major life changes.

Real-World Example: Mike’s Wake-Up Call

Mike, a tech worker who switched jobs five times in a decade, left old 401(k)s scattered across multiple providers. When he finally consolidated and reviewed his accounts, he discovered $20,000 lost to fees and subpar investments. Working with a knowledgeable financial advisor, Mike streamlined his accounts, cut fees, and crafted a plan optimized for his long-term retirement goals. His experience highlights how scattered retirement accounts risk being forgotten, but with a little action, you can regain control — potentially adding tens of thousands back to your future savings.

Understanding How Fees Erode Retirement Growth

Fees are the silent killer of retirement savings. Here’s what to watch:

- Administrative fees: For plan management, compliance, and recordkeeping.

- Investment management fees: Charged by mutual fund companies or asset managers.

- Maintenance fees: Charged regularly on old accounts, even when forgotten.

A higher fee of just 0.5% annually, compared to a low-fee fund, can cost you tens of thousands over time due to lost compound returns. Always scrutinize fee disclosures in your plan statements and seek low-fee investment options.

Federal Government Reopens; Here’s What SNAP, IRS, TSA & Federal Workers Can Expect Now

Retirement Nightmare for Federal Employees: Claims Delayed, Systems Strained, Anger Rising

SSDI Payment Schedule for November 2025: Check Payment Dates and Amounts