November 19 Social Security Payout: Social Security payments are more than just deposits in bank accounts; they are a financial lifeline for millions of Americans, especially retirees who depend on these funds to cover essential expenses such as housing, healthcare, and daily living costs. As the November 19, 2025, Social Security payout approaches, understanding who will receive their payment on this date, why others won’t, and how the Social Security Administration (SSA) manages these payments is critical for proper financial planning. This comprehensive guide simplifies these details, helping retirees, soon-to-be retirees, and caregivers navigate the process confidently. The SSA follows a structured payment schedule based primarily on birthdates and benefit types. This article unpacks the official November payment schedule, eligibility requirements, benefit calculations, recent updates such as cost-of-living adjustments (COLAs), and practical advice to manage your benefits effectively—all written in clear and friendly language suitable for a diverse audience.

November 19 Social Security Payout

The November 19, 2025 Social Security payout is a significant moment for retirees born between the 11th and 20th of any month. Knowing when and how you receive your Social Security income is vital for budgeting and financial security. Alongside the scheduled payments, the upcoming 2.8% cost-of-living adjustment in 2026 ensures your benefits keep pace with inflation, maintaining your buying power. By understanding eligibility details, payment timetables, tax considerations, and how to use SSA’s online tools, you can confidently manage your retirement income. Staying proactive and informed is the best defense against unexpected disruptions to your financial well-being.

| Key Point | Details |

|---|---|

| November 19 Payment Date | For retirees born between 11th and 20th of any month |

| Other Payment Dates | 1st–10th: November 12, 21st–31st: November 26 |

| Early Payments | Recipients with benefits before May 1997 or both Social Security and SSI got paid Nov 3 |

| Cost-of-Living Adjustment (COLA) | 2.8% increase in benefits starting January 2026 |

| Maximum Monthly Benefit 2025 | $4,018 (full retirement age, 67) or up to $5,108 (delayed retirement until 70) |

| Eligibility Criteria | Must have worked at least 10 years and be 62 years or older |

| Tips for Managing Benefits | Set up online account, monitor payments, update info promptly |

The November 19 Social Security Payout Schedule Explained

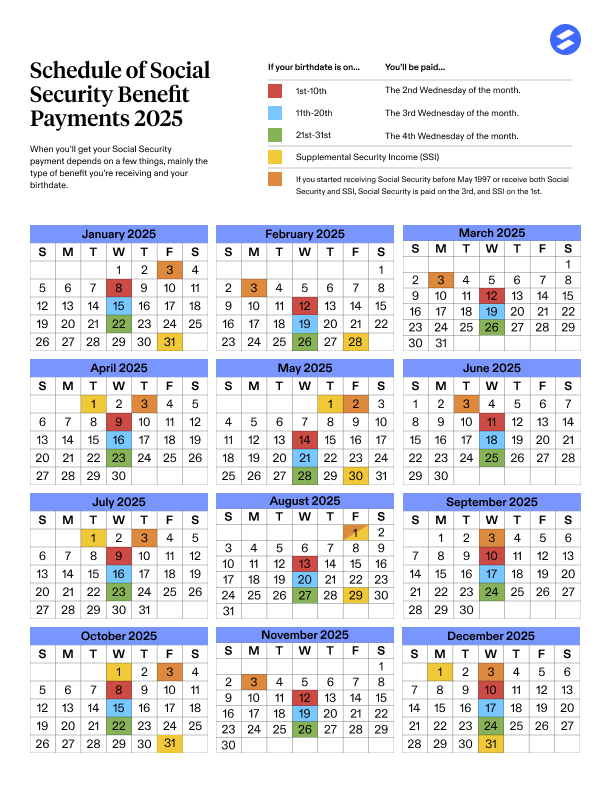

The SSA schedules Social Security payments on Wednesdays each month, distributing payments in groups according to the beneficiary’s birth date to facilitate smooth processing. This staggered schedule reduces systemic delays and helps banks manage the flow of transactions:

- Birthdays between 1st and 10th: Payments will arrive Wednesday, November 12, 2025.

- Birthdays between 11th and 20th: Payments will arrive Wednesday, November 19, 2025.

- Birthdays between 21st and 31st: Payments will arrive Wednesday, November 26, 2025.

Some exceptions apply:

- Beneficiaries who began receiving Social Security before May 1997 or who receive both Social Security and Supplemental Security Income (SSI) were paid early on Monday, November 3.

- SSI-only recipients received their payment early on Friday, October 31 due to November 1 falling on a Saturday.

This scheduling framework is designed to ensure beneficiaries receive timely payments while accommodating processing needs and calendar peculiarities such as weekends and holidays.

Who Will See a Check on November 19? Who Won’t?

Understanding whether you will receive your Social Security payment on November 19 depends on your birth date and benefit type.

Paid on November 19

- Individuals born between the 11th and 20th of any month.

- Those who started receiving benefits after May 1997.

- Beneficiaries who receive Social Security only, excluding those also on SSI.

Not Paid on November 19

- Individuals born between the 1st and 10th and those born after the 20th will get paid earlier or later (November 12 or 26).

- SSI-only recipients received their payments early on October 31.

- Those receiving both Social Security and SSI or those who began benefits before May 1997 were paid November 3.

- If your payment doesn’t show up on November 19 or your scheduled date, it is advised to wait three additional business days before contacting SSA, as delays can happen due to mailing or banking timing issues.

Social Security Eligibility: What You Need to Qualify

Social Security retirement benefits require you to have earned enough work credits. Here’s the rundown:

- You must accumulate at least 40 credits, which equals approximately 10 years of covered work.

- Eligible workers can start claiming benefits as early as age 62, but benefits will be reduced if taken before full retirement age.

- Full retirement age (FRA) varies by birth year but is generally 67 for people born in 1960 or later.

Additionally, non-citizens can qualify if they meet certain work and residency criteria. The SSA regularly updates eligibility rules and benefit adjustments to align with current economic and demographic trends.

How Much Will You Get? Important Benefit Figures for 2025

Knowing your potential benefits allows you to plan your retirement with greater confidence:

- The maximum monthly Social Security benefit for someone retiring at full retirement age (67) in 2025 is approximately $4,018.

- Delaying your benefit until age 70 increases the maximum to about $5,108 per month.

- The average monthly Social Security benefit for retirees is roughly $2,006, reflecting a wide range due to varying earnings histories.

- Benefits are calculated based on your highest 35 years of earnings, adjusted to reflect average wage growth.

- If you claim benefits early, the monthly amount decreases to account for longer expected payout periods.

Cost-of-Living Adjustment (COLA): What It Means for You

Every year, Social Security benefits are adjusted to combat inflation through COLA, which protects purchasing power:

- For 2025, SSA announced a 2.8% COLA increase, effective January 2026, meaning beneficiaries will receive bigger monthly payments starting the new year.

- The calculation relies on the Consumer Price Index for Urban Wage Earners (CPI-W), reflecting how much prices for typical goods and services rise.

- This adjustment is critical because static Social Security benefits can erode with rising rents, healthcare costs, and food prices.

- SSI payments also receive COLA increases but on a separate schedule, with December 2025 seeing adjustments for SSI recipients.

Additional Social Security Benefits and Considerations

Supplemental Security Income (SSI)

- SSI supports seniors, disabled individuals, and needy families with low income and resources.

- Payments are generally issued on the first of every month. However, due to weekends or holidays, these payments sometimes arrive early (like October 31 for November’s payment).

- SSI is distinct from retirement benefits and has separate eligibility and payment rules.

Survivor and Disability Benefits

- Social Security offers disability benefits to qualifying workers unable to work due to illness or injury.

- Survivor benefits help family members of deceased workers.

- Both follow similar payment schedules but may have unique eligibility criteria or documentation requirements.

Medicare Premiums and Social Security Deductions

- Medicare premiums (Part B and Part D) are often automatically deducted from Social Security checks.

- Beneficiaries should confirm deductions match premiums to avoid gaps in coverage.

- Understanding Medicare-related deductions helps plan net benefit amounts accurately.

Step-by-Step Guide: How to Manage Your November 19 Social Security Payout: Like a Pro

Step 1: Know Your Specific Payment Date

Check your birth date against the SSA payment calendar every year. November 19 applies to those born between the 11th and 20th, but dates can vary slightly for some beneficiaries.

Step 2: Create a “My Social Security” Online Account

Signing up at ssa.gov/myaccount unlocks useful features:

- See your payment history and upcoming dates.

- Check your estimated future benefits based on your work record.

- Update personal information and bank details.

- Sign up for electronic payments (recommended for speed and security).

- Apply for benefits or report changes easily.

Step 3: Keep Your Banking Info Updated and Monitor Payments

Incorrect banking info leads to delayed or missed payments. Always verify with SSA any time you change banks or accounts and monitor your account early on payment day.

Step 4: Understand Tax Implications on Social Security Income

Depending on your overall income, up to 85% of your Social Security benefits may be taxable:

- Taxability thresholds depend on your combined income (adjusted gross income + non-taxable interest + half your Social Security benefits).

- For individuals, if combined income exceeds $25,000, expect some tax liability.

- For married couples filing jointly, this threshold is $32,000.

- Consult IRS resources or tax advisors for personalized planning.

Step 5: Stay Informed About Legislative and Policy Changes

Social Security is subject to political and fiscal changes affecting funding, benefits, and eligibility. Keep up with SSA announcements, news, and trusted expert commentary to adjust your retirement strategy accordingly.

$200 Monthly Boost? New Proposal Could Supercharge Social Security Benefits

SSDI Payment Schedule for November 2025: Check Payment Dates and Amounts

$19.5M Wells Fargo Settlement Update; Don’t Miss Your Chance to Claim Thousand