Don’t Forget Your 401(k): Losing your job is a tough pill to swallow. But amidst the stress of new bills, job hunting, and uncertainty, there’s a critical financial detail many people overlook: their 401(k) retirement savings. Experts strongly warn that neglecting your 401(k) or making rash decisions, like cashing out early, could cost you thousands in penalties, taxes, and lost growth — money you’ll want during retirement. This article breaks down everything you need to know about handling your 401(k) after a layoff, in clear terms anyone can understand, yet packed with valuable insights for professionals who want to protect their future.

Don’t Forget Your 401(k)

Losing your job is a big life upheaval, but your 401(k) should not become a casualty. Avoid quick cash-outs, understand your options, and actively manage your retirement assets to protect your financial future. Your 401(k) is your retirement lifeline—treat it like one.

| Topic | Key Points |

|---|---|

| Average 401(k) balances | Average US 401(k) balance in 2025 is $137,800; 600,000+ savers have over $1 million saved |

| Common Mistakes After Job Loss | Cashing out early leads to 10% penalty + income tax; losing employer match; forgotten accounts |

| Options for Your 401(k) After Job Loss | Leave it with old employer, roll over to new 401(k), or IRA; avoid cashing out unless necessary |

| Legal protections & penalties | Early withdrawals under 59½ face 10% penalty (exceptions for age 55+); taxes owed |

| Expert advice | Avoid cash outs, roll over funds, watch vesting schedules, monitor fees |

| Contribution Limits for 2026 | Max contribution $23,500 (under 50); $34,750 for age 60-63 with catch-up |

| Historical Growth | Average 401(k) grew 466% from 2009-2019; compound growth is retirement gold |

| Inflation Impact | Inflation can reduce investment gains; adjust contributions to protect purchasing power |

| Hardship & Loan Rules | Loans must be repaid within 60-90 days post job loss; hardship withdrawals are costly tax-wise |

What is a 401(k) and Why You Should Care?

A 401(k) is your future paycheck—a tax-advantaged retirement savings account, usually funded automatically through deductions from your paycheck, sometimes with an employer match as extra boost. The money is invested in stock funds, bonds, or other investments, growing over decades without being taxed until you take it out.

When you lose your job, your 401(k) doesn’t vanish—it’s still yours. But if you’re not careful, that savings can get derailed through early withdrawals, lost matches, or high fees. That’s why understanding what to do is critical.

What Happens to Your 401(k) When You Lose Your Job?

You have four main options:

- Leave it with your old employer’s plan: If your account is above $5,000, you can keep it there, enjoying tax deferral but with no new contributions.

- Roll it over to your new employer’s 401(k): Consolidates your retirement savings, making it easier to manage.

- Roll it over into an Individual Retirement Account (IRA): Gives you more investment choices and flexibility.

- Cash it out: Usually the worst move due to taxes, penalties, and lost growth.

Why You Should Avoid Cashing Out?

Cashing out early means:

- Taxes and penalties: If you’re under 59½, you pay a 10% early withdrawal penalty plus regular federal and state income taxes.

- Losing employer match: Your employer’s contributions might be subject to vesting. Leaving too soon can mean losing some or all of this free money.

- Lost growth via compounding: Money grows exponentially over time due to compounding interest; cashing out now slashes future gains.

- Reduced retirement income: Less money now means less income during retirement, which can cost you tens of thousands of dollars over the years.

Example: Cashing out $10,000 early could end up costing you around $3,000+ in taxes and penalties alone, and you lose decades of growth on that principal.

Understanding Vesting and Employer Matching

Your own contributions to a 401(k) are always yours. But employer matches often come with a “vesting schedule,” which means you earn the right to your employer’s contributions gradually over a few years. For example:

- 1 year of service = 20% vested

- 5 years = 100% vested

If you leave the company before full vesting, you might forfeit some matched funds. This makes understanding your vesting schedule critical when changing jobs.

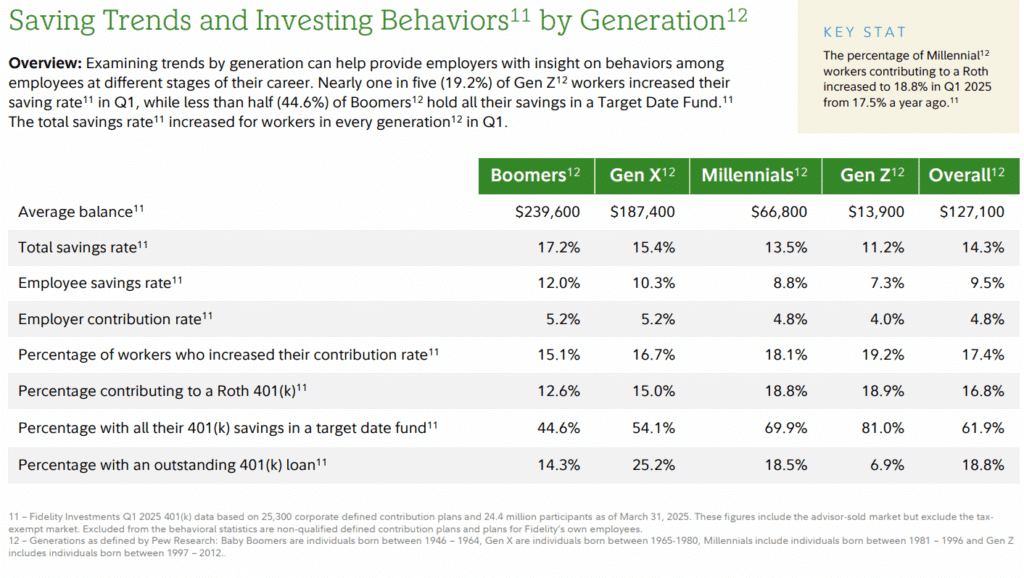

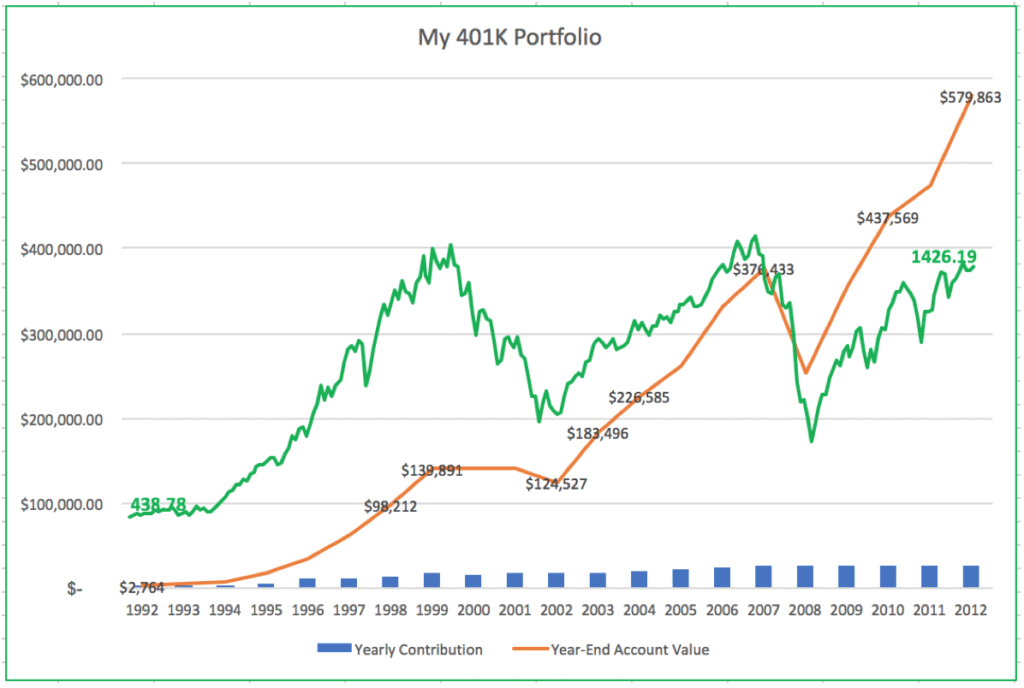

Historical Growth and Why Patience Pays

Fidelity data shows that from 2009 to 2019, the average 401(k) balance grew by roughly 466%, an astronomical annualized gain around 19%, much better than most bank accounts or other investments people had access to. This growth is fueled by continuous contributions and compounding returns.

However, inflation can erode these gains. For instance, if your investments return 7% but inflation is 5%, your real gain is only 2%. This highlights why regular review and adjustment of your retirement strategy are essential for protecting your future purchasing power.

What About Loans and Hardship Withdrawals?

Many 401(k) plans allow loans or hardship withdrawals, but these come with strings:

- After job loss, outstanding loans typically need repayment within 60-90 days, or the balance converts to taxable income and might be subject to penalties.

- Hardship withdrawals are generally subject to income taxes and often a 10% penalty unless exceptions apply (total disability, medical bills, etc.).

- The CARES Act introduced some temporary leniencies during the pandemic, but those rules may no longer apply, so verify your plan’s current terms.

Step-By-Step Guide: What to Do After Losing Your Job

Step 1: Don’t panic. Don’t Forget Your 401(k)

Step 2: Explore your options:

- Leaving the money where it is (if allowed).

- Rolling it over to a new employer’s plan.

- Rolling it over to a traditional or Roth IRA.

Step 3: Consider a direct rollover to avoid taxes and penalties.

Step 4: Know penalty exceptions:

- You can withdraw without penalty if you’re 55+ and have left your job, though taxes may apply.

- Other hardship exceptions exist but often come with tax costs.

Step 5: Monitor your account:

- Watch out for plan fees.

- Keep contributions steady if you find new employment.

- Review investments and rebalance to match retirement goals.

Common Mistakes to Avoid

- Cashing out early—losing money immediately and long term.

- Forgetting about vesting schedules and losing employer match.

- Not rolling over accounts, leading to forgotten or lost money.

- Ignoring fees and poor investment choices in old plans.

- Halting contributions for extended periods after job loss.

New SNAP Rules Take Effect This Month; Millions Could See Their Eligibility Vanish

US Visa Waiver Program 2025 Just Updated; Here’s Who Can Now Enter America Without a Visa

SSDI Payment Schedule for November 2025: Check Payment Dates and Amounts