Is Your ‘Tax-Free Retirement Plan’ the Same Life Insurance Trap? When NASCAR legend Kyle Busch and his wife Samantha paid more than $10.4 million in premiums for an Indexed Universal Life (IUL) insurance policy marketed as a “tax-free retirement plan,” they expected a financial safety net and future tax-free income. Instead, they suffered a staggering loss of over $8.85 million due to hidden fees, misleading promises, and policy mismanagement. This situation has become a cautionary tale for Americans considering similar complicated life insurance plans for retirement. This article dives deep into Kyle’s story, demystifies life insurance retirement plans, outlines risks and alternatives, and offers practical steps to protect your financial future.

Is Your ‘Tax-Free Retirement Plan’ the Same Life Insurance Trap?

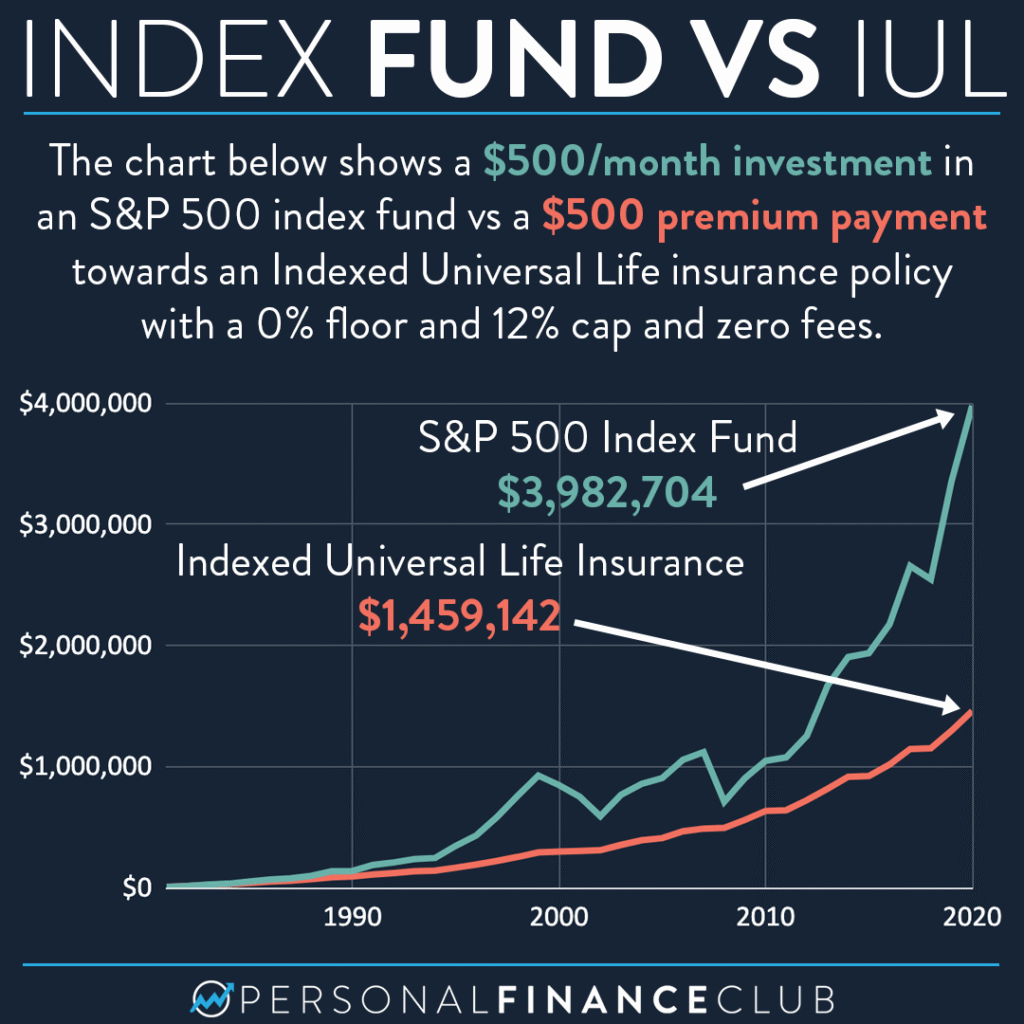

Kyle Busch’s multimillion-dollar loss shines a harsh light on the risks of using Indexed Universal Life insurance as a retirement tool. These policies can be valuable in certain niches but require a clear understanding, distrust of overly optimistic marketing, and careful planning. For most, diversified retirement savings through 401(k)s, IRAs, or brokerage accounts provide better transparency, liquidity, and cost effectiveness. If life insurance retirement plans are on your radar, dive deep into the details, seek multiple perspectives, and avoid sales hype. Your financial security deserves clarity and honesty—not costly complexity.

| Feature | Details |

|---|---|

| Policy Type | Indexed Universal Life (IUL) insurance used as a retirement savings tool |

| Premium Investment | $10.4 million paid by the Busches |

| Loss Amount | Approximately $8.85 million documented loss |

| Promised Benefits | Tax-deferred growth, tax-free retirement income |

| Actual Outcome | High fees, misleading illustrations, fixed account fund placement, long surrender periods |

| Suitability | Typically high-net-worth individuals with maximized traditional savings limits |

| Common Risks | Misrepresentation, complex terms, high commissions, low liquidity, tax implications |

| Recommended Resources | Bankrate: Life Insurance Retirement Plans |

The Kyle Busch Story: What Went Wrong?

Kyle and Samantha Busch purchased their IUL policy through Pacific Life, enticed by the pitch that paying $1 million annually for five years would self-fund a plan generating tax-free retirement income. The couple believed they were making a smart, low-risk investment. Unfortunately, this was not the case.

According to their lawsuit, Pacific Life and its agents failed to disclose the true risks involved, including high insurance costs, commissions, and substantial surrender charges. The policy illustrations presented to the Busches promised unrealistic growth and benefits that never materialized. In fact, a major failing was that the policy funds were allegedly kept in a fixed account instead of being allocated to indexed accounts that promised market-linked returns, which severely limited growth. Additionally, assurances that the policy’s death benefit would be optimized for income generation were allegedly not honored.

Kyle Busch said, “We tried to do what we thought was best for our family and future, but it turned into a massive financial scam.” This lawsuit is now shining light on misleading life insurance sales tactics and complex policy designs that leave many policyholders vulnerable.

What Are Life Insurance Retirement Plans (LIRPs) and How Do They Work?

LIRPs use permanent life insurance policies like whole life or IUL to build cash value while maintaining a death benefit. Unlike term insurance, which only provides coverage, permanent insurance builds savings on a tax-deferred basis.

Mechanism of LIRPs:

- Premium Payments: Part covers the insurance cost and part goes to cash value.

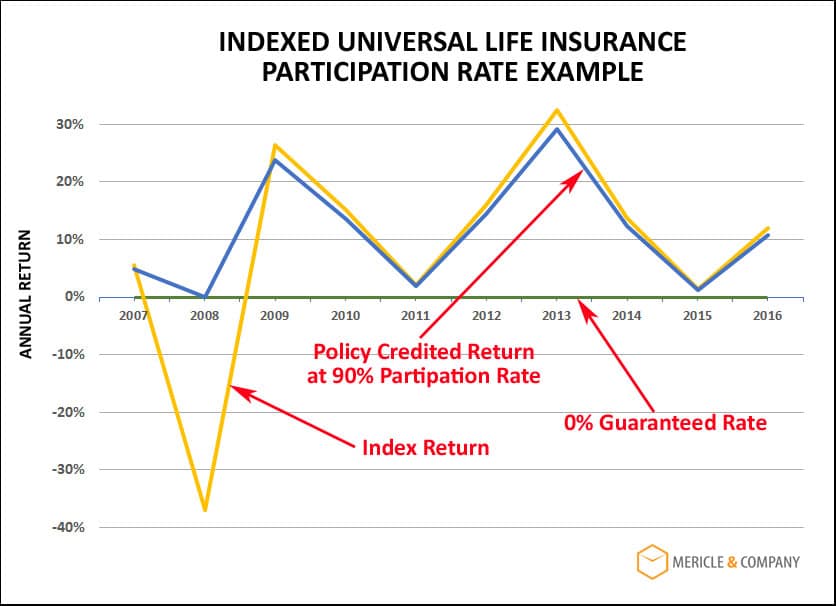

- Cash Value Growth: Cash value grows either via guaranteed interest rates or market index gains with protections against losses (as with IUL).

- Access to Cash Value: Policyholders can borrow against or withdraw cash value, often tax-free up to the amount paid in premiums.

- Death Benefit: Pays beneficiaries minus any loans or withdrawals not repaid.

The allure is tax deferral and tax-free access, which may supplement traditional retirement income.

The Real Risks: Why Kyle’s Loss Is a Larger Warning

Kyle Busch’s experience reveals several key risks common to many LIRPs:

- Excessive Fees and Commissions: Significant portions of premiums fund agent commissions and insurance costs. In Kyle’s case, commissions reportedly tripled based on the policy design.

- Misleading Sales Illustrations: Many agents use optimistic returns without fully disclosing costs, fees, or surrender penalties.

- Long Surrender Charges: Penalties for early cancellation often last 10-16 years, trapping policyholders.

- Improper Fund Allocation: Funds supposed to grow linked to market indexes may be held in fixed accounts with minimal growth.

- Negligence Allegations: Agents failing to disclose risks, not switching death benefit types, or developing policies primarily to maximize commissions are common issues highlighted in the lawsuit.

- Tax Complexity: Loans against policies reduce death benefits and can cause tax problems if mismanaged.

For Kyle, these factors contributed to losing the majority of their investment in just a few years—a scenario many investors do not anticipate

Comparing LIRPs to Other Retirement Vehicles

| Retirement Tool | Tax Advantages | Liquidity | Fees | Risk Level | Best For |

|---|---|---|---|---|---|

| LIRPs (IUL) | Tax-deferred growth, tax-free loans | Limited; surrender penalties apply | High (commissions, fees) | Moderate to high | Diversification post-401(k)/IRA |

| 401(k)/IRA | Tax deferral; tax on withdrawal | Limited (penalties before 59½) | Low to moderate | Market risk | Wage earners and savers |

| Roth IRA | Tax-free growth and withdrawals | Contributions flexible | Low | Market risk | Broad use, especially younger |

| Brokerage Account | No tax deferral; taxed dividends/gains | Very liquid | Variable | Market risk | Flexible investing |

| Annuities | Tax-deferred, sometimes guaranteed | Limited liquidity | Moderate to high | Variable | Supplemental steady income |

How to Spot a ‘Tax-Free Retirement Plan’ the Same Life Insurance Trap?

- Red Flags in Sales Pitches: Promises of guaranteed, high tax-free returns with minimal risk.

- Complex or Vague Policies: Difficulty finding simple explanations of how money grows or fees apply.

- Pushy Sales Tactics: Urgency to buy now or limited-time offers.

- Excessive Upfront Commissions: These indicate conflict of interest where agents push products for commissions.

- Long Lock-in Periods: High surrender charges prevent exit without loss.

- Promises Without Documentation: Verbal assurances not backed by policy terms or illustrations.

Practical Steps to Evaluate Life Insurance Retirement Plans

- Clarify Your Goal: Distinguish between protection and investment needs.

- Understand the Policy: Confirm it is permanent insurance with cash value accumulation.

- Request Full Illustrations: Look for fees, commissions, surrender charges, and realistic return scenarios.

- Get Multiple Opinions: Consult a fiduciary financial advisor, ideally fee-only.

- Compare Alternatives: Evaluate traditional retirement accounts, taxable investments, or annuities.

- Check the Agent’s Credentials: Verify licensing and review history.

- Review the Surrender Terms: Know how long you are locked in and penalties for early exit.

- Monitor the Policy: Track actual cash value growth vs projections annually.

IRS Announces 2026 Retirement Contribution Limits; Here’s What’s Changing for Your 401(k) and IRA

New SNAP Rules Take Effect This Month; Millions Could See Their Eligibility Vanish

SSDI Payment Schedule for November 2025: Check Payment Dates and Amounts