Delayed Jobs Report and Key Economic Data Will Finally Drop: The U.S. government’s reopening signals a major turning point after the longest federal shutdown in American history, spanning a staggering 43 days. This closure halted the publication of vital economic data, most notably the September 2025 jobs report and other critical measures such as inflation and GDP. With government services resuming, the delayed economic data is set to be released soon, providing important insights into the nation’s economic health during a tumultuous period. This article offers an in-depth look at the delayed reports, the impact of the shutdown on the economy, and practical guidance on what the numbers mean for American workers, businesses, and investors.

Delayed Jobs Report and Key Economic Data Will Finally Drop

The conclusion of the longest government shutdown in U.S. history marks a new chapter for economic transparency and recovery. The forthcoming September 2025 jobs report release on November 20 is crucial for understanding the labor market disruptions during the shutdown. Coupled with other delayed economic releases due soon, these reports provide vital insight into the nation’s financial health, guiding critical decisions for workers, businesses, investors, and policymakers. Being informed and prepared is key to navigating the uncertain months and years ahead.

| Topic | Details |

|---|---|

| September 2025 Jobs Report | Release date: November 20, 2025; Includes hiring, layoffs, and unemployment rate |

| October 2025 Jobs Report | Partial release expected (nonfarm payrolls only); unemployment rate may be excluded |

| November 2025 Jobs Report | Scheduled for December 5, 2025; expected to provide fuller data |

| Impact of Shutdown | Longest shutdown caused 43-day delay in data collection and reporting |

| Economic Data Delays | Other key reports like inflation and GDP pending; schedule being updated |

What Is the Jobs Report and Why Is It Important?

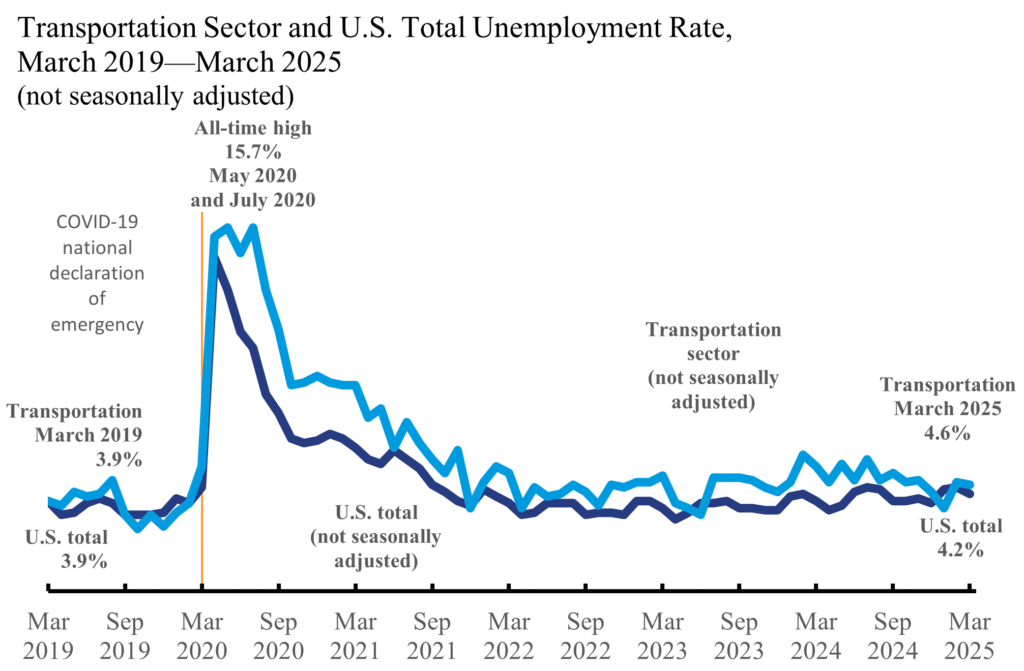

The monthly jobs report, issued by the Bureau of Labor Statistics (BLS), is one of the most closely watched economic indicators. It tracks employment trends across the country, reporting on the number of jobs added or lost, the unemployment rate, average wages, and labor force participation.

Understanding this report is crucial because:

- Jobs drive economic growth: More employed people means more spending on goods and services, fueling expansion.

- Wages signal economic pressure: Rising wages often indicate a tight labor market but may also lead to inflation.

- Fed policy hinges on employment data: The Federal Reserve adjusts interest rates based on labor market conditions to control inflation and encourage growth.

- Investor decisions are swayed: Strong employment data boosts market confidence, while weak numbers can trigger sell-offs.

The delayed release means for weeks, economists, policymakers, and markets have been without vital data, increasing uncertainty about the state of the economy.

When Will the Delayed Jobs Report and Key Economic Data Be Released?

Key upcoming releases include:

- September 2025 jobs report: Set for release on November 20, 2025. This report will shed light on labor trends during the shutdown.

- October 2025 jobs report: Expected to be a partial release, missing some key data like unemployment rates because of incomplete surveys.

- November 2025 jobs report: Scheduled for December 5, 2025, anticipated to provide a fuller picture.

Other important economic reports—such as inflation figures, consumer spending, and GDP data—are also delayed, with release schedules being updated to catch up on the backlog.

The Economic Fallout of the Shutdown: Bigger Than You Think

The 43-day shutdown inflicted substantial damage on the economy, beyond just delayed numbers:

- The Congressional Budget Office (CBO) estimates the shutdown shaved off $18 billion from gross domestic product (GDP) in the fourth quarter of 2025 alone.

- Over 2 million federal civilian employees were furloughed without paychecks, causing serious financial strain across communities nationwide.

- Small businesses reliant on federal contracts and loans were particularly hard-hit: approximately 4,800 businesses missed out on about $2.5 billion in loans, losing an average of $371 million each month.

- Local government services and programs faced cutbacks due to halted federal funding, impacting vulnerable populations.

- The shutdown disrupted supply chains, delayed permits, and caused uncertainty in private sector projects relying on government authorization.

- Consumer confidence dipped noticeably as the shutdown extended into the key spending months of November and December, threatening holiday retail sales.

Analysts warn that although some lost economic activity may be recouped as government functions normalize, a significant amount—estimated between $7 billion and $14 billion—is likely permanent due to missed opportunities and halted projects.

What to Expect in the September Delayed Jobs Report and Key Economic Data?

When the September jobs report is released, these main data points will be under scrutiny:

- Nonfarm payroll change: The headline figure showing job gains or losses in all sectors except farming.

- Unemployment rate: The share of the labor force currently without work but actively seeking employment.

- Average hourly earnings: A measure of wage growth influencing consumer purchasing power and inflation.

- Labor force participation: The percentage of working-age Americans employed or looking for work.

- Job sector breakdowns: Which industries thrived or struggled during the shutdown—critical for pinpointing economic shifts.

This report is especially important because it will provide one of the first comprehensive looks at the labor market’s condition during a period otherwise cloaked in uncertainty.

Simplifying the Jobs Report: What You Need to Know

Confused by economic jargon? Here’s a quick rundown:

- Employment gains mean more people are working and usually signal a healthy economy.

- Rising unemployment suggests trouble, with fewer people able to find jobs.

- Wage growth shows how fast workers’ paychecks are increasing, which can be good—but rapid wage growth can also push prices up (inflation).

- Stable or rising hours worked usually indicate stronger demand for labor.

These simple markers can help everyday Americans and professionals interpret the news and make sound decisions.

Practical Tips for Businesses, Workers, and Investors

Economic data isn’t just for economists—its effects trickle down to everyone:

- For businesses: Use the reports to decide on hiring, inventory levels, or expansion. Strong job growth encourages investment while downturns suggest caution.

- For workers: Understand the labor market’s strength to negotiate raises, consider career moves, or seek new opportunities.

- For investors: Gauge economic trends to adjust your portfolio between growth and value stocks or to anticipate Federal Reserve rate changes.

For example, a report showing robust wage growth might signal inflation concerns, prompting investors to brace for higher interest rates, which can depress stock prices.

The Wider Economic Picture: Inflation, GDP, and Consumer Spending

The shutdown also delayed other critical reports:

- Inflation reports help understand cost-of-living increases affecting consumers and monetary policy.

- GDP data measure overall economic output and health.

- Consumer spending figures reveal how confident Americans feel about their finances.

These reports will follow soon, completing the economic puzzle and offering clearer signals for the direction of the U.S. economy.

How the Shutdown Shifted Economic Forecasts?

The unexpected government halt forced economists to revise forecasts dramatically:

- Goldman Sachs cautioned the shutdown could slice 1.5 percentage points off fourth-quarter GDP growth (annualized).

- JPMorgan analysts estimated each week of shutdown chops 0.1 percentage point off GDP growth.

- The CBO projected a cumulative GDP impact of about $11 billion for the six-week shutdown period in real 2025 dollars.

Despite expected rebound in early 2026, the lost momentum and consumer confidence will linger, potentially slowing down recovery.

What’s Next? Being Prepared in an Uncertain Economy

With data starting to flow again, here’s how to stay ahead:

- Follow official channels: Track releases from the Bureau of Labor Statistics and the Bureau of Economic Analysis.

- Stay informed: Read expert analysis to understand report implications.

- Plan ahead: Workers should keep skills current and businesses should remain flexible with hiring and spending.

- Watch markets carefully: Investors should expect volatility around data release dates and factor in economic uncertainty in decisions.

Understanding the data allows you to respond strategically whether you’re managing a career, a business, or investments.

Justice Hantz Marconi Steps Back From All Cases; Still Set to Collect $111K Pension in February

Retirement Nightmare for Federal Employees: Claims Delayed, Systems Strained, Anger Rising

IRS Announces 2026 Retirement Contribution Limits; Here’s What’s Changing for Your 401(k) and IRA