Colorado Stimulus Check 2025: If you’re living in Colorado, you’ve probably heard a lot of buzz about the Colorado Stimulus Check 2025, also known as the TABOR refund. This big state payout sends money back into the hands of taxpayers when Colorado collects more tax revenue than it’s allowed to keep under a constitutional rule called the Taxpayer’s Bill of Rights (TABOR). Wondering who gets this money? When it’s hitting your bank? How much you can expect? And maybe even how to plan if you’re waiting for yours? This article breaks everything down clearly—for everyone from kids to pros—so you understand all the ins and outs. The Colorado Stimulus Check 2025 packages up to $1,130 for individual residents and drops it right in your account or mailbox. It’s not just a one-off cash splash but a sign that Colorado’s economy overperformed in 2024. This payout is landing just in time to help with winter expenses, like heating bills, groceries, and gift shopping. Let’s unpack how this all works, who benefits, and how to make sure you get yours on time.

Colorado Stimulus Check 2025

The Colorado Stimulus Check 2025 is a significant reflection of a thriving economy and Colorado’s dedication to taxpayer rights. For those who lived in Colorado all year and filed taxes, up to $1,130 is heading your way by November, through direct deposit or check. This refund not only provides vital financial relief during winter but symbolizes the state’s commitment to transparency and prudent fiscal management. Keep your tax filings timely and accurate, update your direct deposit info, and check for updates. Your TABOR refund is waiting – it’s your own money returned, with respect.

| Feature | Details |

|---|---|

| Program Name | Colorado TABOR Refund 2025 |

| Maximum Refund | Up to $1,130 per individual |

| Total Payout | Around $1.2 billion across Colorado |

| Eligibility | Full-year Colorado resident for 2024, Age 18+, Filed 2024 state tax return |

| Payment Dates | October – November 2025 |

| Payment Method | Direct deposit or mailed check |

| Official Website | Colorado Department of Revenue |

What Is the Colorado Stimulus Check 2025?

Colorado’s Stimulus Check is part of an economic rule called TABOR (Taxpayer’s Bill of Rights). TABOR limits how much money the state government can keep from your taxes. When the state collects more than that limit—like in 2024 when Colorado’s economy was booming—it has to refund the extra money back to taxpayers starting the following year.

This means the money you get isn’t a gift or handout; it is actually your own tax dollars coming back to you because the state collected above the legal limit. TABOR was created to ensure that government spending and revenue collection don’t grow faster than inflation and population growth combined, keeping government accountable and taxpayer-friendly.

In 2025, Colorado is expected to return roughly $1.2 billion to residents through this refund. Over 3 million Coloradans are expected to receive payments, making it one of the largest disbursements in recent years.

What makes this different from federal stimulus checks is that Colorado’s refund is automatic for qualifying residents who have filed their tax returns—it’s a state constitutional requirement, not a discretionary program.

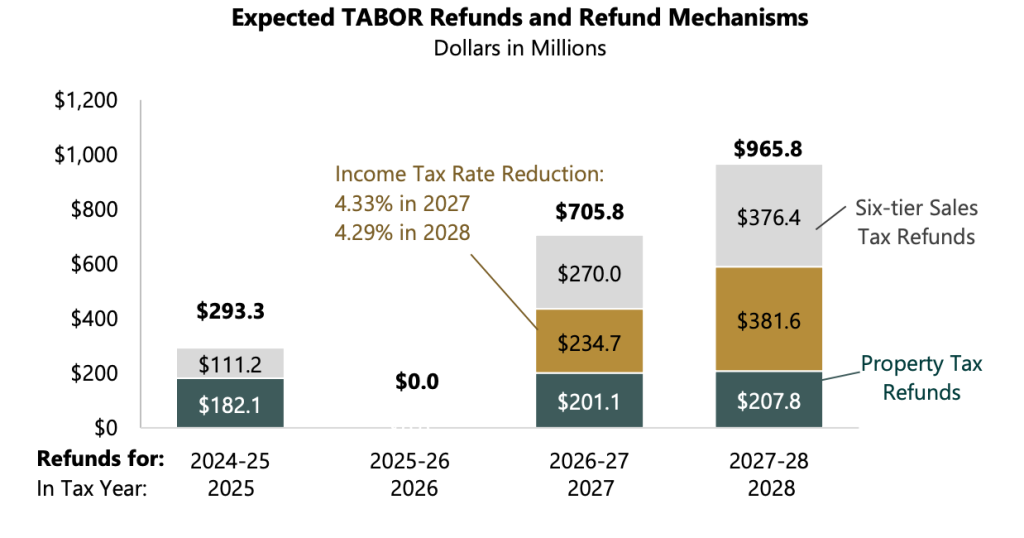

A Historical Look: TABOR Refunds Over the Years

To really understand how big the 2025 stimulus is, it helps to look at the history of TABOR refunds. The Taxpayer’s Bill of Rights was passed by Colorado voters in 1992 as a constitutional amendment designed to put a cap on revenue and spending by the state and local governments.

- The first TABOR refunds started around 1997, initially through sales tax rebates.

- In 2005, Referendum C gave the state a temporary break that allowed it to retain more revenue and reduce refunds to stabilize finances during and after a recession.

- More recently, between 2022 and 2024, we’ve seen a surge in refund sizes, partly due to strong economic recovery after the pandemic.

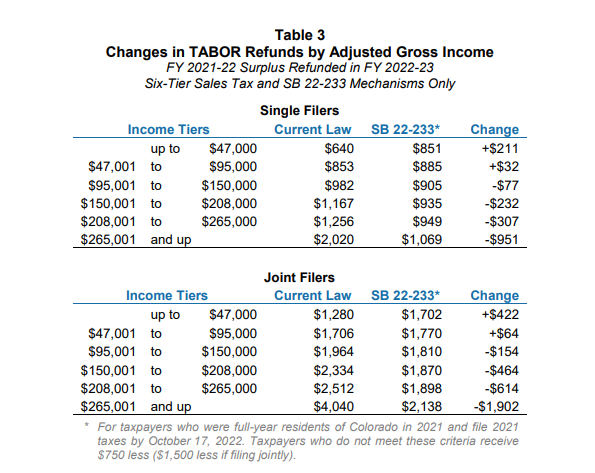

- For example, in 2022, Coloradans got checks averaging $750 for singles and $1,500 for joint filers. In 2023, the amount increased to around $800 and $1,600 respectively.

- The 2024 refunds averaged $326 for singles, lower due to some legislative adjustments and a more modest surplus.

- The 2025 refund is forecasted to be up to $1,130 per person, with some projections even suggesting amounts as high as $1,700 because of booming sectors like technology, tourism, and renewable energy in Colorado.

This marks what some experts are calling a “crazy TABOR surplus era,” with the potential for refunds each year through at least 2027. Over time, the structure and method for how refunds are calculated and distributed have evolved, but the core principle remains: return surplus revenue to taxpayers.

Who Qualifies for the Colorado Stimulus Check 2025?

You might be wondering, “Am I eligible?” Here’s the lowdown:

- Residency: You must have been a full-year resident of Colorado for calendar year 2024. If you moved in or out during the year, you do not qualify.

- Age: You must be 18 years or older before January 1, 2024.

- Filing Status: You need to have filed your 2024 Colorado state income tax return. Filing is mandatory to receive the refund; no separate application is necessary.

- Identification: You must have a valid Social Security Number (SSN) or Taxpayer Identification Number (TIN).

- Dependents: If you are claimed as a dependent on another person’s tax return, you are not eligible for an individual payment.

If you meet these criteria—and filed your state taxes—you’re very likely to receive a refund this year.

How Much Money Will You Get?

The amount you receive depends on the state’s surplus and the number of eligible claimants, but full-year residents can expect up to $1,130 per individual. Married couples filing jointly usually get double that amount.

Comparing this to prior years, this 2025 refund is one of the highest amounts in TABOR history, illustrating Colorado’s strong economic performance. The state expects to distribute around $1.2 billion total in these refunds, a significant payout that rivals federal stimulus levels in impact, though the mechanism is different.

When Will You Get Paid?

Timing is key when budgeting for expenses. Here’s the payment schedule:

- Payments begin as early as October 2025.

- Taxpayers who provided direct deposit information with their tax returns will receive their refunds electronically first, meaning quick access to funds.

- Those who did not provide bank info will get their refunds via mailed paper checks between October and November.

- The Colorado Department of Revenue aims to complete all payments by the end of November 2025.

Receiving your check before the onset of cold weather and holiday spending is intentional, to provide timely financial relief for families facing higher utility bills and other seasonal expenses.

How to Make Sure You Get Colorado Stimulus Check 2025?

This refund doesn’t require extra forms or applications, but attention to your tax filing is essential:

- File your 2024 Colorado state income tax return by the April 15, 2025 deadline (or file for an extension if necessary).

- Double-check your direct deposit information on your tax return to speed up payment processing.

- Keep your mailing address current if you expect a paper check.

- Stay informed of any state announcements by visiting the official Colorado Department of Revenue website.

- If you file electronically through tax software or a tax preparer, verify that your information is complete and accurate.

What If You Missed Filing Your Taxes?

Life happens. Here’s what you can do:

- If you missed filing your 2024 Colorado tax return, get caught up ASAP—late filing still qualifies you for a refund.

- Filing late means delayed payment, but it ensures you do not lose your refund entitlements.

- If you need help, contact programs like the IRS Volunteer Income Tax Assistance (VITA) or local tax professionals to guide you through the process.

How Does This Affect Your Taxes?

One of the best parts? The TABOR refund is not taxable income on your federal or state returns. You won’t pay taxes on this money, and it won’t affect your eligibility for other tax credits or government benefits. It’s pure refund cash.

Additional Resources and Support for Coloradoans

Beyond the TABOR refund, there are several other programs that might help:

- Colorado Earned Income Tax Credit (EITC), which supplements the federal EITC for low- and moderate-income working families.

- Low-Income Energy Assistance Program (LEAP), which helps with heating bills.

- Property tax exemptions for seniors, veterans, and disabled residents.

- Special programs for affordable housing, healthcare, and education assistance.

Why TABOR Refunds Matter: The Bigger Picture

The TABOR refunds are more than financial handouts. They reflect Colorado’s commitment to:

- Fiscal responsibility: Capping government revenue growth and avoiding overspending.

- Taxpayer empowerment: Returning surplus funds transparently and fairly.

- Economic stimulation: Putting money directly back into the hands of residents, who then spend it locally, supporting jobs and businesses.

- Promoting political trust by honoring voter-approved limits and boundaries on taxation.

Real Life Example: Making It Real

Consider a single mom working two jobs to make ends meet. The 2025 TABOR refund landing in November means she can cover her heating bill for the winter months, buy extra groceries, or even get holiday gifts for her kids—without taking on debt.

For a small business owner, the refund might cover inventory costs or invest in advertising to boost sales during the holidays—helping sustain local jobs.

Planning Your Budget With the Stimulus

This refund presents an excellent chance to get ahead financially. Smart moves include:

- Paying down high-interest credit card debt.

- Setting aside funds for an emergency rainy-day fund.

- Investing in energy-saving home upgrades that reduce future bills.

- Supporting local businesses to help keep the community thriving.

Think of this refund not only as extra cash but also as a tool to strengthen your financial footing.

It’s Official: $1,750 Rebate Checks Are Coming; Here’s the Full November 2025 Payout Schedule

IRS Announces 2026 Retirement Contribution Limits; Here’s What’s Changing for Your 401(k) and IRA

$200 Monthly Boost? New Proposal Could Supercharge Social Security Benefits