Bank of America Just Launched ‘401k Pay’: Planning for retirement can often feel like a complex puzzle with many pieces and unanswered questions. But here’s some good news: Bank of America has introduced an innovative solution called 401k Pay, designed to make managing retirement income easier and more straightforward than ever. Whether you’re just getting started on your savings journey or are already gearing up for retirement, this digital tool aims to help you convert your 401(k) savings into a steady, manageable paycheck once you’ve stopped working. Forget the usual confusing financial jargon and complicated setups. 401k Pay puts everything in one accessible digital hub where you can set, track, and adjust your retirement income anytime. This tool is all about making your savings work smarter during your retirement years with flexibility and simplicity, tailored right to your needs.

Bank of America Just Launched ‘401k Pay’

Bank of America’s launch of 401k Pay is a significant milestone in retirement income management. This smart, flexible, and user-friendly digital solution bridges the gap between accumulating savings and effectively turning those savings into a reliable retirement income. Whether you’re close to retirement or have decades to save, 401k Pay offers a modern approach to managing your money with confidence, control, and clarity. Taking advantage of tools like this can elevate your retirement planning and give you peace of mind about your financial future. Start using 401k Pay to take control of your retirement income journey today.

| Feature | Details |

|---|---|

| Launch Date | November 17, 2025 |

| Cost | Free to plan participants and employers |

| Target Audience | Bank of America clients in the Personal Retirement Strategy program |

| Key Benefits | Seamlessly turns 401(k) savings into income, flexible deposit choices, real-time tracking |

| Employee Needs Addressed | Retirement education (36%), income generation (33%) |

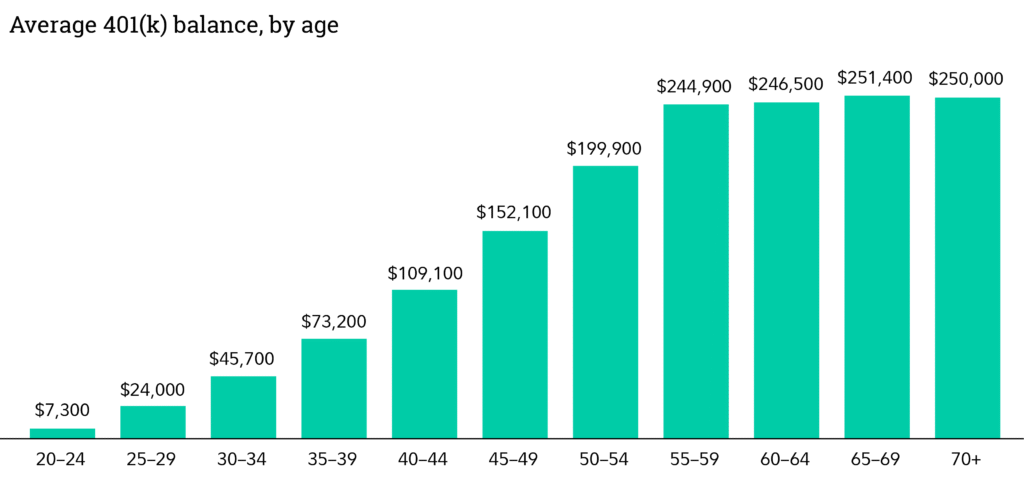

| Average 401(k) Savings Rate | Approx. 12% total savings rate (including employer contributions, 2024 Vanguard data) |

| IRS 2025 Contribution Limits | $23,500 annually, plus $7,500 catch-up for 50+ |

What is 401k Pay?

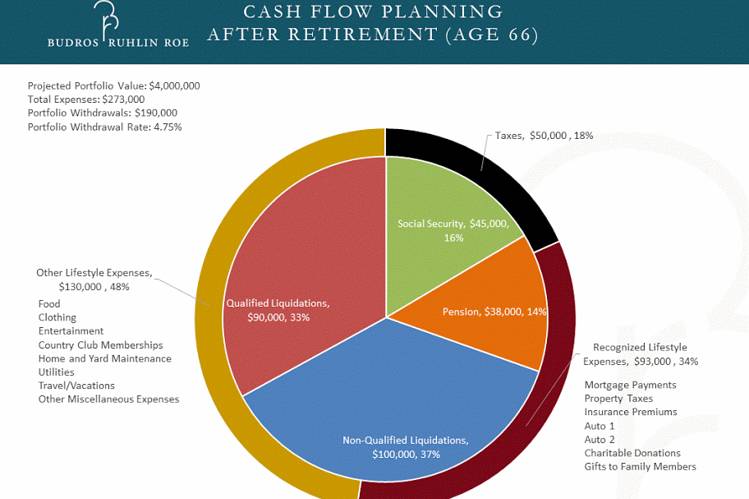

401k Pay is a groundbreaking digital solution introduced by Bank of America that simplifies retirement income management. Imagine having all your 401(k) savings information, personalized planning tools, and flexible deposit options brought together in one intuitive platform available right on your smartphone or computer.

Unlike traditional retirement income options that can be complex or rigid, 401k Pay gives you full control to decide how much income you want monthly or quarterly, where it should be deposited, and when to adjust your payouts—all in real time. It’s like having a personal retirement income assistant available 24/7 to guide and adapt your money flow as your needs change.

This tool is built on Bank of America’s existing Personal Retirement Strategy program, adding a layer that helps plan participants not just save but confidently turn those savings into income.

Why 401k Pay is a Game-Changer for Your Retirement?

Many Americans wrestle with uncertainty when it comes to turning their retirement savings into reliable income. Concerns about covering everyday expenses, healthcare, or unexpected costs can make retirement feel stressful and unmanageable.

401k Pay addresses these concerns directly by making retirement income:

- Easier to Understand and Manage: No more confusing spreadsheets or multiple accounts to monitor. Everything you need lives in one user-friendly digital hub.

- Flexible According to Your Lifestyle: Want monthly deposits? Quarterly? Or want to pause for a bit? You have the freedom to choose or change.

- Personalized Income Planning: It takes your full financial picture into account, including cost of living, taxes, and federal requirements.

- Up-to-date and Responsive: Your income stream adjusts in real time as your financial situation evolves.

- Cost-Free: There’s no additional fee for you or your employer to use this tool.

In short, 401k Pay gives you freedom, clarity, and peace of mind over your retirement income.

Features and Benefits: A Closer Look

401k Pay is more than just a paycheck generator—it’s a comprehensive retirement income management system designed to tackle the challenges both employees and employers face.

- Consistent Income Generation: Helps you understand how much income your 401(k) savings can realistically provide tailored to your lifestyle.

- Flexible Deposit Options: Select from a variety of payment frequencies and bank accounts, even accounts outside of Bank of America, for convenience.

- Real-Time Recalibration: If life throws a curveball—medical bills, moving expenses, travel—you can adjust your income on the fly.

- Centralized Dashboard: Access to 401(k) recordkeeping, income planning tools, and advice — all in one place.

- Improving Workplace Outcomes: Bank of America notes this tool could boost employee satisfaction, productivity, and retention by reducing financial stress.

Lorna Sabbia, Bank of America’s Head of Workplace Benefits, shares, “401k Pay was developed in collaboration with our corporate clients who wanted a simple yet powerful retirement income solution to support their employees. Incorporating this as part of workplace benefits helps create a foundation for better financial futures and improved business results.”

How Does 401k Pay Compare to Other Retirement Income Tools?

Before 401k Pay, many retirees relied on annuities, Roth IRAs, or complex payout plans—each with limitations.

| Feature | 401k Pay | Annuities | Other Payout Plans |

|---|---|---|---|

| Flexibility | Real-time modification possible | Fixed or variable, usually less adaptable | Often less integrated and flexible |

| Control | User-centric, via digital platform | Managed by insurer | Provider-dependent |

| Fees | No additional fees for users | Potential high fees | Varies, sometimes high |

| Integration | Integrated with Bank of America’s retirement services | Usually standalone product | Often fragmented |

| Ease of Use | Simple, clear digital interface | Can involve complex contracts | Varies |

A Real-Life Scenario: Jill’s Journey to Retirement Confidence

Consider Jill, a 58-year-old teacher from Ohio. Over the years, she’s steadily saved in her employer’s 401(k) offered through Bank of America. As Jill nears retirement, she worries if her savings will cover healthcare costs and family visits.

With 401k Pay, Jill logs into her retirement dashboard, sets a monthly income goal, and opts for direct deposits into her checking account. When her old house surprise fixer-upper bills arrive, she tweaks her income plan quickly. Jill’s stress diminishes, replaced by control and clarity over her financial future.

Security and Privacy: Keeping Your Retirement Safe

Security is paramount when it comes to digital financial tools. Bank of America protects 401k Pay users with industry-leading cybersecurity measures including bank-grade encryption, multi-factor authentication, and 24/7 monitoring.

By safeguarding your financial data with these advanced protocols, Bank of America lets you manage your retirement income digitally without compromising your peace of mind.

Expert Insight

John Smith, a Certified Financial Planner, emphasizes: “401k Pay represents a leap forward in how retirees manage their income streams. Its real-time adaptability and user-centered design are features many savers have long needed.”

Tom Matarazzo of Bank of America adds, “Planning how much income participants will need and how to draw it down remains a top concern. 401k Pay directly addresses this with a state-of-the-art digital experience.”

How to Get Started with Bank of America Just Launched ‘401k Pay’?

- Confirm if your employer offers the Bank of America Personal Retirement Strategy program.

- Enroll or verify your enrollment in the program.

- Access 401k Pay through your Bank of America retirement account dashboard after its November 17, 2025 launch.

- Use the interactive tools to establish your retirement income goals and preferences.

- Contact your plan administrator or Bank of America support for any assistance.

SSDI Payment Schedule for November 2025: Check Payment Dates and Amounts

New SNAP Rules Take Effect This Month; Millions Could See Their Eligibility Vanish

US Visa Waiver Program 2025 Just Updated; Here’s Who Can Now Enter America Without a Visa

The Importance of Financial Wellness in Retirement

Financial wellness and peace of mind at work translate directly to better employee engagement and productivity. Bank of America designed 401k Pay to empower employees to understand their finances deeply, reducing stress around retirement readiness.

Studies show employees who feel confident about their financial future perform better and are more loyal. This tool supports that vital relationship between personal finance and professional well-being.