Arizona’s Minimum Wage Is Rising: Starting January 1, 2026, if you’re working in Arizona, your paycheck is about to get a little fatter thanks to the state’s minimum wage increase from $14.70 to $15.15 per hour. While it might sound like a small jump, this increase tackles a bigger challenge—helping workers keep up with the rising cost of living in a state experiencing rapid growth and economic change. This wage hike isn’t a random act. It ties directly to inflation, designed to ensure workers’ paychecks do not lose their purchasing power as prices for everyday essentials rise. Here’s a detailed guide to understanding what this change means, who it affects, local exceptions, and why it matters for workers and employers alike in Arizona.

Arizona’s Minimum Wage Is Rising

Arizona’s scheduled rise to $15.15 per hour in 2026 is a testament to the state’s commitment to fair wages. With local exceptions like Flagstaff and Tucson offering even stronger pay floors, workers are better protected against inflation and economic pressures. For employers, adapting to these changes means updating payroll, managing budgets, and focusing on workforce retention. For employees, it means fairer compensation and greater financial stability. Together, these measures strengthen Arizona’s economy, helping it grow in a way that supports both employers and the workforce fairly and sustainably.

| Topic | Data / Statistic | Additional Details |

|---|---|---|

| Arizona Statewide Minimum Wage 2026 | $15.15 per hour | Increase of $0.45 from $14.70 (2025) |

| Tipped Minimum Wage 2026 | $12.15 per hour | Tipped workers may receive tips plus wage, with a $3.00 tip credit |

| Flagstaff Minimum Wage 2026 | $18.35 per hour (no tipped wage) | All employees must earn full minimum wage regardless of tips |

| Tucson Minimum Wage 2026 | $15.45 per hour (tipped wage: $12.45) | Applies to employees working at least 5 hours/pay cycle; some exemptions apply |

Understanding Arizona’s Minimum Wage Is Rising in 2026

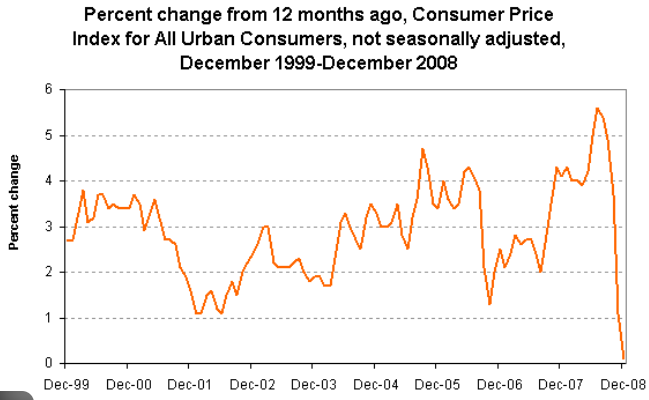

Arizona’s annual minimum wage adjustments are based on the Consumer Price Index (CPI), linking wage increases to inflation rates. This annual mechanism was established by Proposition 206, the Fair Wages and Healthy Families Act, passed by voters in 2016 with the goal of ensuring wages grow in line with the rising cost of living.

The 2026 increase to $15.15 per hour reflects this design, increasing 45 cents from the previous year’s $14.70. For tipped workers—such as restaurant servers who earn most of their pay through tips—the base wage is increasing from $11.70 to $12.15 per hour, with a maximum $3 tip credit allowed. Employers count tips plus wages toward reaching the full minimum wage threshold of $15.15 per hour.

This system safeguards minimum wage earners from inflation eroding the real value of their paychecks, helping Arizona’s workers maintain a stable standard of living despite economic ups and downs.

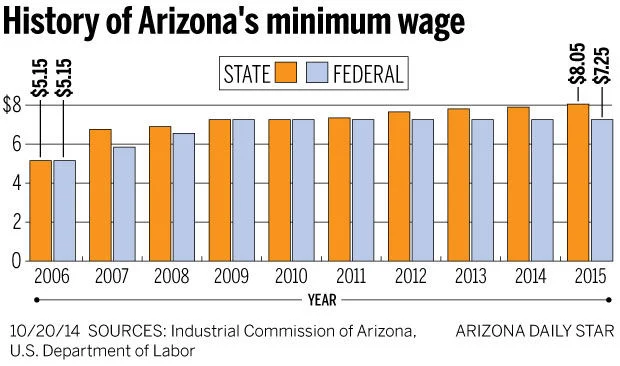

Arizona Minimum Wage History: Setting the Context

Understanding where Arizona is today on minimum wage requires tracing its history. While the federal minimum wage was established at 25 cents an hour in 1938, Arizona laid its first serious foundation for statewide minimum wage protections with the Arizona Minimum Wage Act in 2006, moving away from decades of static or inadequate minimum pay.

A major milestone came with Proposition 206 in 2016, which implemented a phased approach to raising the minimum wage to $12 per hour by 2020. This law also included the provision for indexed increases based on CPI, helping to institutionalize wage growth linked to inflation.

Between 2017 and 2020, Arizona saw steady annual increases culminating in the $12 mark, a significant step in improving pay for low-wage workers. Since then, inflation-based adjustments each year have continued to raise the wage, including reaching $14.70 in 2025 and now $15.15 set for 2026. This clear, predictable progress contrasts with historical wage stagnation patterns and sets Arizona apart as a state striving for economic fairness through structured policy.

Real Impact: Breaking Down the Arizona’s Minimum Wage Is Rising

While a 45-cent raise might not seem like a game-changer, its cumulative impact tells a different story. A full-time worker putting in 40 hours a week will earn an additional $18 weekly, which roughly translates to $78 more per month before taxes. Annually, that’s nearly $1,000 extra—a meaningful boost for individuals and families juggling expenses.

For example, consider Jane, a server at a local diner in Phoenix. That extra money can help her with practical needs—paying medical bills, affording better groceries, or even saving a bit for emergencies. It’s not just about numbers but about reducing financial stress and enhancing quality of life.

This wage increase also means greater consumer spending power, which can have ripple effects improving local economies by increasing demand for goods and services.

Local Wage Laws: What You Should Know About Flagstaff and Tucson

Arizona’s minimum wage law is robust, but a couple of cities go further with higher local minimum wages reflecting their specific economic climates.

Flagstaff: The High Roller’s Minimum Wage

Flagstaff voters approved Proposition 414 in 2016 (The Minimum Wage Act), aiming to provide all city workers a livable wage. By 2026, Flagstaff’s minimum wage will be an impressive $18.35 per hour, substantially above the state baseline.

Flagstaff also eliminated the tipped wage category starting 2025. This means every worker earns at least $18.35 hourly regardless of tips, ensuring servers, bartenders, and other traditionally tipped workers have stable, guaranteed earnings.

Tucson’s Two-Tier Approach

Tucson passed its own minimum wage update in 2021, setting the 2022 minimum at $13.00, with programmed annual increases indexed to inflation. For 2026, the rate is $15.45 per hour for most workers, with a tipped wage of $12.45 per hour for those who regularly receive tips.

Tucson’s law covers employees working at least 5 hours per pay cycle, with exemptions including federal workers and certain casual labor categories.

These local adjustments acknowledge the cost-of-living differences within Arizona, helping workers in more expensive areas get paid accordingly.

What Does This Mean for Employers and Businesses?

Staying Compliant

Employers need to update payroll systems and employee compensation structures to reflect the new wage rates starting January 1, 2026. Posting updated minimum wage notices in workplaces is legally required to keep employees informed.

Budgeting for Wage Growth

Higher labor costs may pressure small business budgets, leading some to reconsider staffing levels, prices, or overtime policies. Strategic wage planning becomes essential to balance fair pay with business sustainability.

Training and Retaining Staff

Conversely, paying competitive wages often reduces costly employee turnover and improves morale. Businesses investing in their workforce through fair pay tend to enjoy better customer service, higher productivity, and a stronger reputation.

Practical Tips for Workers

- Know your rights: Familiarize yourself with the new wage standards to ensure you’re paid accordingly from 2026 onward.

- Keep detailed records: Save pay stubs, track hours worked, and compare them to expected wages.

- Understand tip credits: If you work in a tipped position, your combined tips and base wage must meet at least $15.15 per hour.

- Reach out for help: If you suspect wage violations, contact the Arizona Industrial Commission or the U.S. Department of Labor’s Wage and Hour Division.

How Does This Compare to the National Minimum Wage?

The federal minimum wage has been stuck at $7.25 per hour since 2009, while many states like Arizona have moved to increase the floor significantly. Arizona’s 2026 rate of $15.15 places it among the higher state minimum wages nationwide, a reflection of its economic growth and living costs.

Arizona’s approach highlights regional needs for wage adjustments that the federal minimum does not address, helping states support their local economies and workforce welfare better.

The Bigger Picture: Minimum Wage and the Economy

Increasing minimum wages impacts several areas of the economy:

- Poverty reduction: Higher wages lift workers and families out of poverty, reducing reliance on social assistance programs.

- Consumer spending: Increased earnings fuel local economies through higher buying power.

- Employment: While some worry about job losses, research shows gradual, inflation-indexed wage increases tend to have minimal negative employment effects.

- Business costs: Higher wages may push some businesses to adapt pricing, investment in automation, or staffing models.

Arizona’s model of gradual, inflation-linked wage increases is widely viewed by economists as a balanced, effective strategy to support workers without disrupting the economy abruptly.

Kyle Busch Lost $8M; Is Your ‘Tax-Free Retirement Plan’ the Same Life Insurance Trap?

3 Social Security Surprises Coming in 2026; And How They Could Affect Your Benefits

$200 Monthly Boost? New Proposal Could Supercharge Social Security Benefits