NJ Judge Loses $140K Pension: A New Jersey judge lost a $140,000 pension after a state appellate court upheld denying her lifetime retirement benefits, due to a serious breach of public trust. This landmark case shines a spotlight on how judicial misconduct can lead to pension forfeiture and emphasizes the vital importance of ethics in public service careers.

NJ Judge Loses $140K Pension

The case of former Judge Carlia Brady losing a $140,000 pension over harboring a fugitive boyfriend underscores how seriously New Jersey treats breaches of public trust. Judge misconduct not only risks legal and reputational damage but can cost a lifetime of retirement security. New Jersey’s robust pension forfeiture laws reflect a commitment to high ethical standards and public accountability, sending a clear message to all public servants: Integrity matters—now and forever.

| Topic | Details |

|---|---|

| Judge’s Name | Carlia M. Brady |

| Location | Middlesex County, New Jersey |

| Pension Value | $140,000 |

| Reason for Pension Denial | Harboring boyfriend (fugitive) while judge, breach of public trust |

| Court Decision Date | October 22, 2024 |

| Legal Basis | NJ Revised Statutes on pension forfeiture due to misconduct involving public office |

| Impact | Forfeiture of lifetime pension despite disability claim |

| Official Court Document | NJ Courts Appellate Division |

What Happened?

Carlia M. Brady, a former Superior Court judge in Middlesex County, New Jersey, faced allegations she harbored her boyfriend, who was a fugitive wanted for armed robbery. Despite Brady’s claims of permanent disability, which under normal circumstances would entitle her to a pension, the court ruled that her involvement in this serious ethical breach disqualified her from receiving retirement benefits.

The decision sends a strong message: Judges, entrusted with upholding the rule of law, must maintain impeccable ethical standards or risk losing even their earned retirement rights. The case highlights how misconduct—whether or not it results in a criminal conviction—can severely impact public officials’ post-service benefits, underscoring the importance of accountability.

Understanding Pension Forfeiture in New Jersey

New Jersey’s pension forfeiture law (N.J.S.A. 43:1-3.1) governs the conditions where public employees—including judges—may lose all or part of their pension if convicted of crimes related to their official duties or if they commit misconduct undermining public trust.

What Constitutes Forfeitable Misconduct?

- Criminal acts related to office such as bribery, theft, fraud, or corruption.

- Serious ethical violations that dishonor one’s public office or damage public confidence.

- Misconduct that reflects moral turpitude and breaches the fiduciary duty owed to the public.

The law allows pension boards and courts to order either full or partial pension forfeiture, calculated to reflect the date when misconduct began, thus ensuring the penalty fits the nature and extent of wrongdoing balanced against service length.

This legal framework is designed to protect taxpayers by ensuring that public servants who break the law or violate ethical standards do not keep the financial fruits earned through public trust.

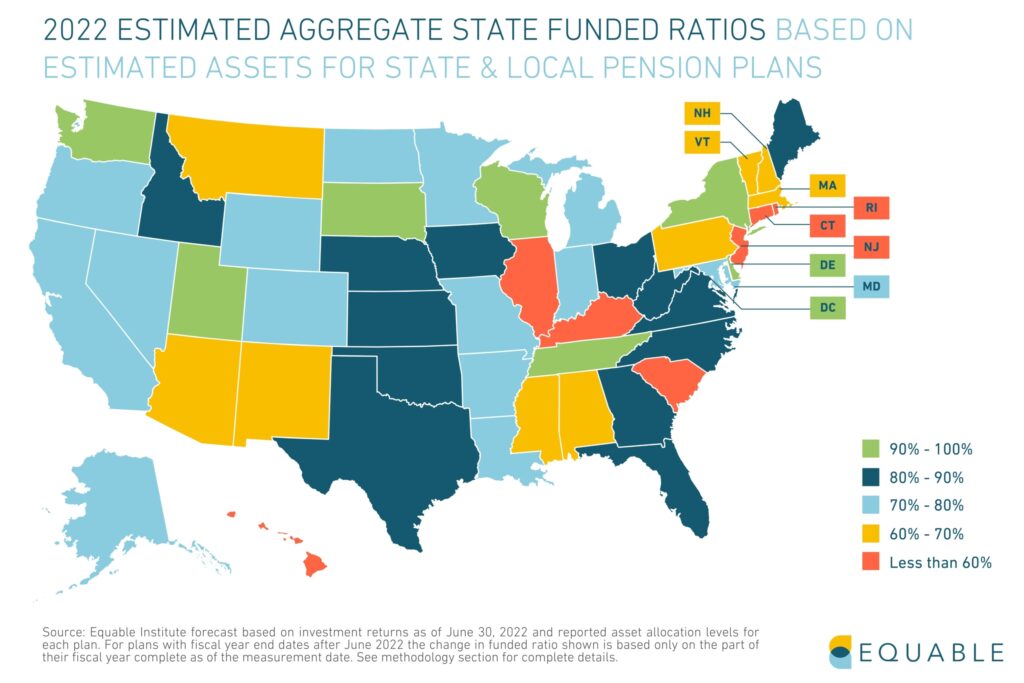

The Bigger Picture: Pension Forfeiture Nationwide

Pension forfeiture laws vary widely across the United States. Some states mandate forfeiture only for criminal convictions, while others, like New Jersey, extend the rule to serious ethical violations that harm public trust—even without a conviction.

Nationwide data suggests:

- Thousands of public officials face pension discipline annually, but cases involving judges and higher officials are rare due to the ordinarily high burden of proof.

- New Jersey is among the states with comprehensive pension forfeiture laws aimed at enhancing public accountability.

- Legal experts emphasize the delicate balance between protecting earned benefits as deferred compensation and enforcing consequences for breach of trust.

This reflects an evolving trend to tighten ethical oversight and discourage misconduct in public service sectors.

How Public Pensions Work and What Losing One Means?

Pensions are a deferred compensation mechanism designed to reward years of service. Typically, for judges and other public officials, pensions are calculated based on salary and years served.

For example:

- Brady’s pension value of $140,000 reflects accumulated contributions and anticipated retirement benefits.

- Pensions provide critical financial security after retirement, often serving as the primary income source.

- Losing a pension not only means a significant loss of income but can also jeopardize healthcare benefits tied to retirement status.

The financial impact is severe, with pension forfeiture sometimes being equivalent to losing decades of retirement savings overnight.

Public Trust and Judicial Ethics: Why They Matter

Judges are uniquely entrusted to uphold justice with impartiality and integrity. The Model Code of Judicial Conduct and local judicial ethics codes require judges to avoid conduct that compromises the judiciary’s reputation.

By harboring a fugitive, Brady’s actions clashed directly with these standards, undermining the role of judges as guardians of the law and fairness.

Why is Public Trust So Critical?

- Judicial legitimacy depends on the public’s perception of impartiality and integrity.

- Breaches of ethics erode confidence in legal outcomes and democratic governance.

- Ethical lapses can discourage citizen engagement and cooperation with the justice system.

Losing pension rights serves as a powerful deterrent and reinforces that judges are not above the laws and ethical expectations they enforce.

Impact on Public Confidence

Corruption or misconduct among judges has wide-reaching consequences beyond individual punishment. It leads to:

- Public skepticism about justice and fairness.

- Undermining faith in government institutions.

- Calls for broader reforms in judicial oversight and accountability.

New Jersey’s enforcement of pension forfeiture in this case helps affirm to citizens that misconduct is taken seriously, helping to rebuild trust.

The Legal Process for Pension Forfeiture

The pension forfeiture process generally follows this sequence:

- Investigation: Often initiated by pension boards or oversight authorities following allegations.

- Finding of Guilt or Breach: Can be a criminal conviction, a guilty plea, or an administrative finding of misconduct.

- Hearing: Formal proceedings where evidence is presented.

- Decision on Forfeiture: Pension may be partially or fully forfeited, with calculations reflecting misconduct start date.

- Appeals: Pensioners can appeal forfeiture decisions through courts or administrative reviews.

In Brady’s case, the appellate court’s ruling reflects full judicial scrutiny to ensure the decision balanced fairness against protecting public trust.

NJ Judge Loses $140K Pension: Historical Context and Legislative Background

New Jersey’s pension forfeiture laws evolved from early 20th-century foundations where pensions were viewed as a gratuity, to modern recognition of pensions as property rights but conditional upon honorable service.

- The 2007 Pension Forfeiture Act strengthened penalties, requiring pension forfeiture for convictions of first- or second-degree crimes connected to public service.

- Boards must consider factors like nature of misconduct, moral turpitude, and years of service before ordering forfeiture.

- Courts apply a balancing test weighing misconduct severity against pension rights to avoid excessive penalties.

This law reflects New Jersey’s commitment to ethical governance while ensuring penalties are just and measured.

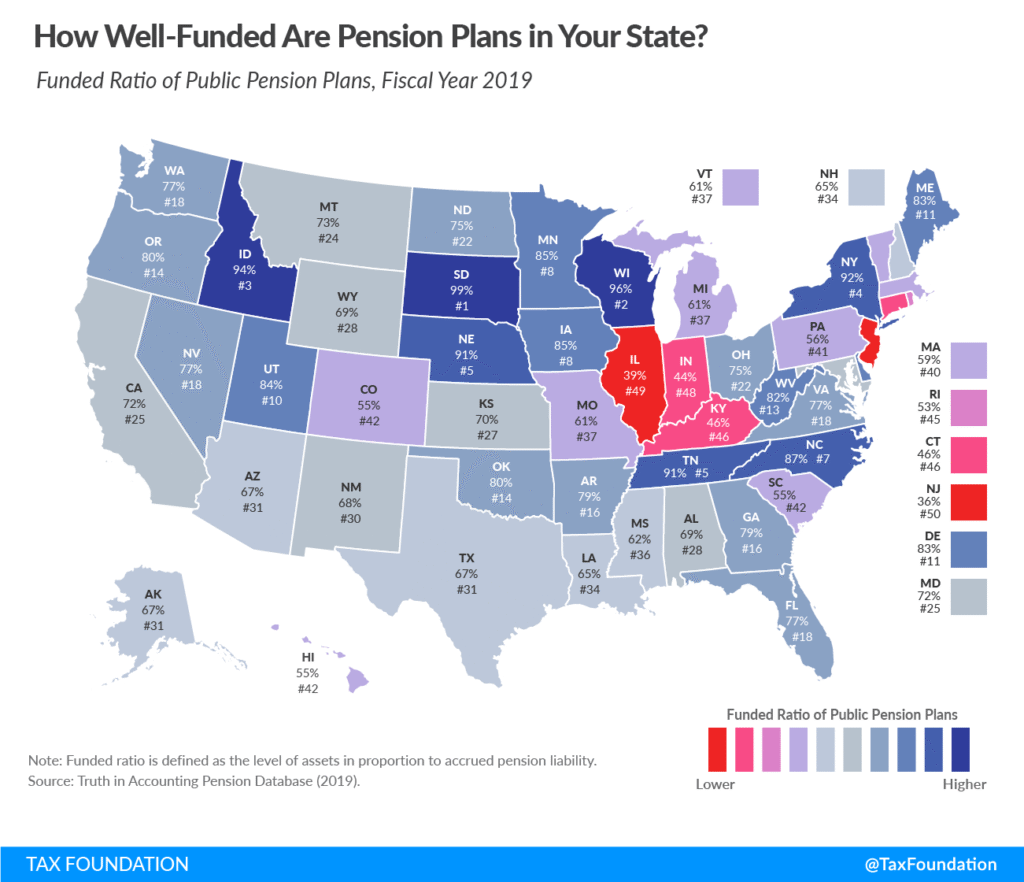

Comparing New Jersey to Other States

Different states have different standards:

| State | Requirement for Pension Forfeiture | Extent of Forfeiture |

|---|---|---|

| New Jersey | Criminal conviction or serious ethical breach | Partial or full forfeiture possible |

| California | Only criminal convictions related to office | Full forfeiture when convicted |

| Texas | Conviction or official misconduct findings | Partial forfeiture, discretionary |

| Florida | Mainly criminal convictions | Full forfeiture on felony convictions |

New Jersey’s approach is notable for including ethical breaches beyond convictions, demonstrating a broader pursuit of accountability.

Practical Advice for Public Officials As NJ Judge Loses $140K Pension

To preserve career and pension rights, public officials should:

- Commit to ongoing ethics education.

- Avoid conflicts of interest or questionable relationships.

- Seek legal counsel promptly when under investigation.

- Maintain transparent records and decision-making.

- Report unethical behavior observed in peers.

Staying proactive in ethical compliance protects not just reputation but financial security.

Federal Government Reopens; Here’s What SNAP, IRS, TSA & Federal Workers Can Expect Now

New SNAP Rules Take Effect This Month; Millions Could See Their Eligibility Vanish

US Visa Waiver Program 2025 Just Updated; Here’s Who Can Now Enter America Without a Visa