3 Social Security Surprises: If you’re gearing up for Social Security in 2026, get ready for some important changes coming your way that could affect how much you receive and how you manage your benefits. From a significant 2.8% Cost-of-Living Adjustment (COLA) boost to increased earnings limits and a higher taxable income cap, these updates will impact millions of Americans relying on Social Security income. Whether you’re retired, working while collecting benefits, or receiving disability support, understanding what’s new and how it affects you is critical for making informed financial decisions. This article lays out the details in clear, straightforward language that anyone can follow, but also includes deeper insights to help professionals and planners optimize benefit strategies in 2026 and beyond.

3 Social Security Surprises

Social Security in 2026 brings a promising 2.8% cost-of-living boost, allowing benefits to keep pace with inflation, along with expanded earnings limits to give retirees more income flexibility. Meanwhile, rising taxable income thresholds and disability benefit adjustments reflect the ever-changing financial landscape. These updates present opportunities and challenges—understanding and planning for them ensures that you maximize your benefits while managing costs effectively. Remember to stay proactive, keep abreast of your personal earnings data, and consider these changes carefully when planning your retirement or work choices.

| Social Security Changes 2026 | Impact | Data/Stats | Professional Insight |

|---|---|---|---|

| 2.8% COLA increase | Avg. $56/month benefit increase | Avg. monthly $2,071 (up from $2,015) | Helps counter inflation, keeping benefits relevant |

| Earnings limit increase (before full retirement age) | Earn up to $24,480 without penalties | Up from $23,400 | Allows more earnings flexibility for workers |

| Earnings limit increase (year you reach FRA) | Earn up to $65,160 without penalties | Up from $62,160 | More income allowed as you approach FRA |

| Maximum taxable earnings rise | Payroll taxes on income up to $184,500 | Up from $176,100 | Increased Social Security tax base |

| Full retirement age now officially 67 | Affects when full benefits become available | Higher age for full benefits | Important planning factor for benefit claims |

| Disability earnings limits and SSI payments increase | Slightly higher earnings allowed for disabled | SSI $994 individual max, $1,491 couple max | Helps maintain benefit values for vulnerable populations |

What’s Changing With Social Security in 2026?

The biggest update for 2026 is the 2.8% COLA, which means Social Security benefits will rise starting January 2026 to help recipients offset inflation’s bite. For the average retiree, that’s about an additional $56 per month.

But that’s just the tip of the iceberg:

- Earnings limits for working beneficiaries are increasing, giving you more room to earn without losing benefits if you haven’t reached full retirement age.

- The maximum earnings subject to Social Security taxes are going up, meaning higher wage earners will pay Social Security taxes on more income.

- The full retirement age (FRA) is now officially 67 for many, affecting when you can collect your full benefits.

- Updates to disability thresholds and Supplemental Security Income (SSI) limits align with inflation and help protect vulnerable populations.

Each of these changes plays a role in balancing the financial health of the Social Security program while better serving its beneficiaries.

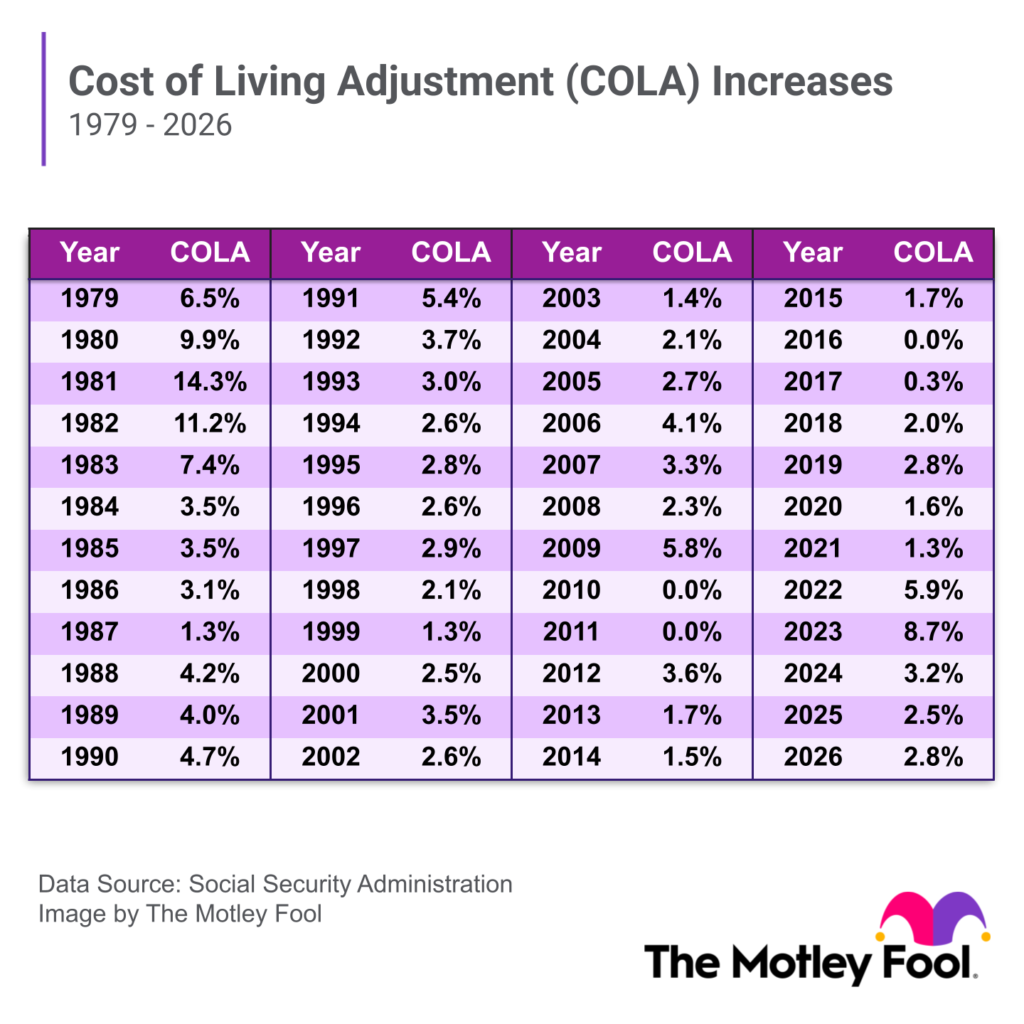

What Is the Cost-of-Living Adjustment (COLA)? And Why Does It Matter?

Understanding COLA’s Purpose

The Cost-of-Living Adjustment (COLA) is designed to help your Social Security benefits keep pace with inflation — the general rise in prices for necessities such as food, housing, and healthcare. Without COLA, the value of your fixed Social Security payments would gradually erode as prices go up.

The 2.8% COLA increase for 2026 comes from SSA’s annual calculation, which measures changes in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), focusing on the average price changes between the third quarters of 2024 and 2025. This narrow inflation index has been criticized for not fully matching retirees’ spending patterns, particularly because it underweights housing and healthcare costs, which tend to rise faster than average.

How is the COLA Calculated?

Each year, SSA compares the average CPI-W for July, August, and September (the third quarter) of the current year with that of the previous year when the last COLA was applied. The percentage increase becomes your COLA for the next year. If prices fall or stay flat, there is no COLA decrease, as benefits do not decline in case of deflation.

For 2026, the 2.8% is slightly higher than last year’s 2.5% but below the decade average of 3.1%. This translates to approximately an additional $56 per month for the average beneficiary, lifting the typical monthly payment to about $2,071.

Important Note About Medicare Premiums

While COLA boosts your benefits, Medicare Part B premiums are expected to rise by 11.6% in 2026, meaning that for many, these increased healthcare premiums will reduce the net benefit increase from COLA. Planning for this premium bump is essential in managing your monthly budget effectively.

Work and Social Security: New Earnings Limits for 2026

What Are Earnings Limits?

If you’re under full retirement age and collecting Social Security benefits, there’s a cap on how much you can earn before some of those benefits get withheld.

Increased Earnings Limits for 2026

- Under full retirement age all year: You can make up to $24,480 before SSA begins to reduce your benefits, up from $23,400 in 2025.

- The year you reach full retirement age: The earnings limit rises to $65,160, up from $62,160.

- After full retirement age: You can earn any amount without affecting your benefits.

How Do These Limits Impact You?

Let’s say it’s 2026 and you’re 64 years old, earning $26,000 and collecting Social Security. You’re $1,520 over the limit for people under full retirement age. SSA will deduct $760 in benefits (half of the amount over the limit). Once you hit full retirement age, you won’t face any deductions no matter how much you work.

SSA has also introduced a monthly earnings test for the first year you receive benefits to make managing earnings easier and reduce surprises.

Why Are These Limits Increasing?

They’re adjusted annually to account for inflation and changes in the economy, giving retirees more flexibility to keep working while collecting their Social Security.

Rising Payroll Tax Cap and What It Means

Maximum Taxable Earnings Increase

For 2026, the maximum amount of earnings subject to Social Security taxes jumps to $184,500 from $176,100 in 2025. This is the “wage base,” and you pay payroll taxes (split between employee and employer) only up to this amount.

Why Does This Matter?

- If you earn above $184,500, you won’t pay Social Security taxes on income exceeding that threshold.

- The increase means higher income workers pay more into Social Security, supporting future program solvency.

- Paying Social Security taxes on more income can lead to higher future benefits since benefits are calculated based on lifetime earnings capped at the taxable maximum.

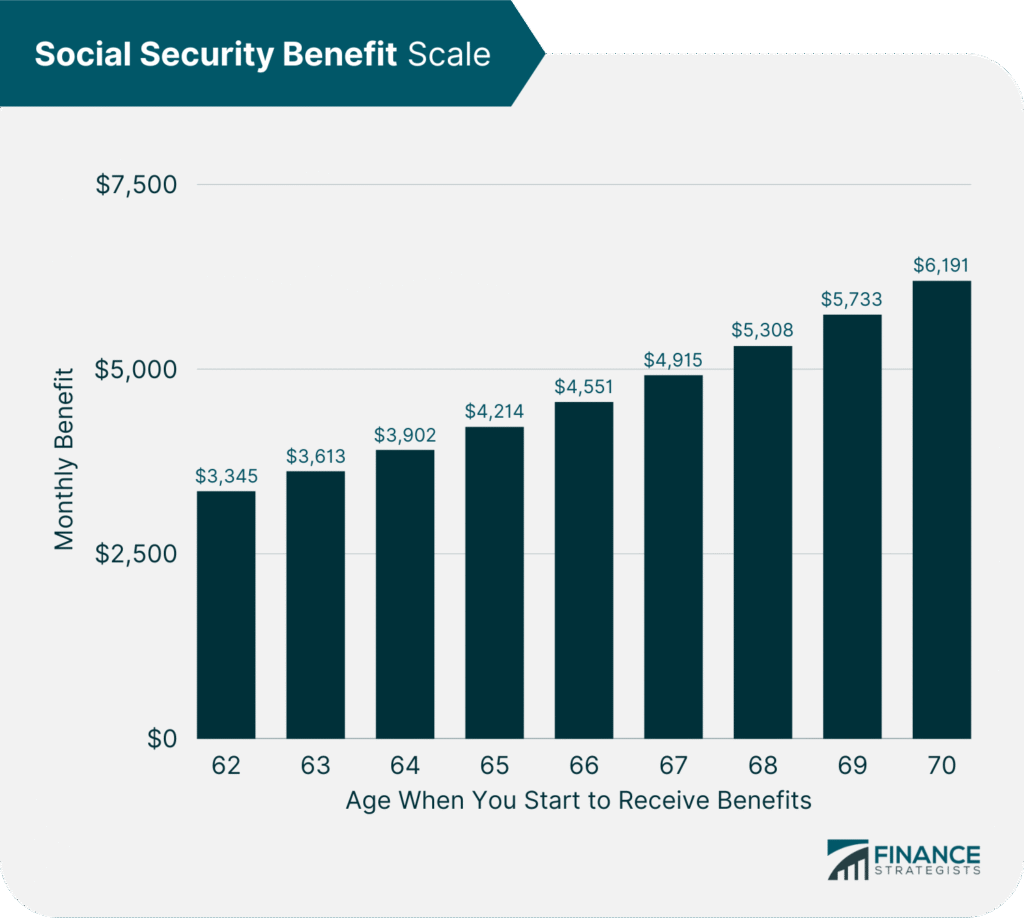

Full Retirement Age Raised to 67

If you were born in 1960 or later, your full retirement age (FRA) is officially 67. This means:

- You won’t be eligible for full benefits until 67.

- Claiming Social Security early (starting at age 62) will lead to permanently reduced monthly benefits.

- Delaying benefits beyond FRA, up to age 70, can increase your payments by up to 8% per year.

Knowing your FRA helps you time your claim to maximize lifetime benefit income, especially with the new earnings limits. To put it simply: waiting usually pays off, but working within the new earnings rules gives you flexibility.

Updates to Disability and Supplemental Security Income (SSI)

Disability Earnings Thresholds

- Substantial Gainful Activity (SGA) limits increase to $1,690/month for non-blind recipients and $2,830/month for blind recipients.

- The Trial Work Period (TWP) limit, which lets disability recipients test work ability without losing benefits, increases to $1,210/month.

SSI Payment Increases

- The federal SSI payment standard rises to $994/month for individuals and $1,491/month for couples.

- These increases help protect disabled and low-income Americans by keeping up with inflation.

These annual adjustments reflect the SSA’s commitment to preserving benefit value for those most in need.

How to Get the Most Out of 3 Social Security Surprises?

- Regularly review your Social Security Statement online. Visit ssa.gov/myaccount to stay updated on your earnings record and estimated benefit amount.

- Time your benefits carefully. Since the full retirement age for many is now 67, waiting past that age can significantly increase your monthly payments.

- Work smart under income limits. If you plan to work before full retirement age, keep your earnings below the new limits to avoid deductions.

- Prepare for higher Medicare costs. Consider how the increase in Medicare Part B premiums will impact your net income.

- Understand tax implications. Higher payroll taxes on increased taxable earnings should be factored into your overall financial planning.

Federal Government Reopens; Here’s What SNAP, IRS, TSA & Federal Workers Can Expect Now

SSDI Payment Schedule for November 2025: Check Payment Dates and Amounts

US Visa Waiver Program 2025 Just Updated; Here’s Who Can Now Enter America Without a Visa